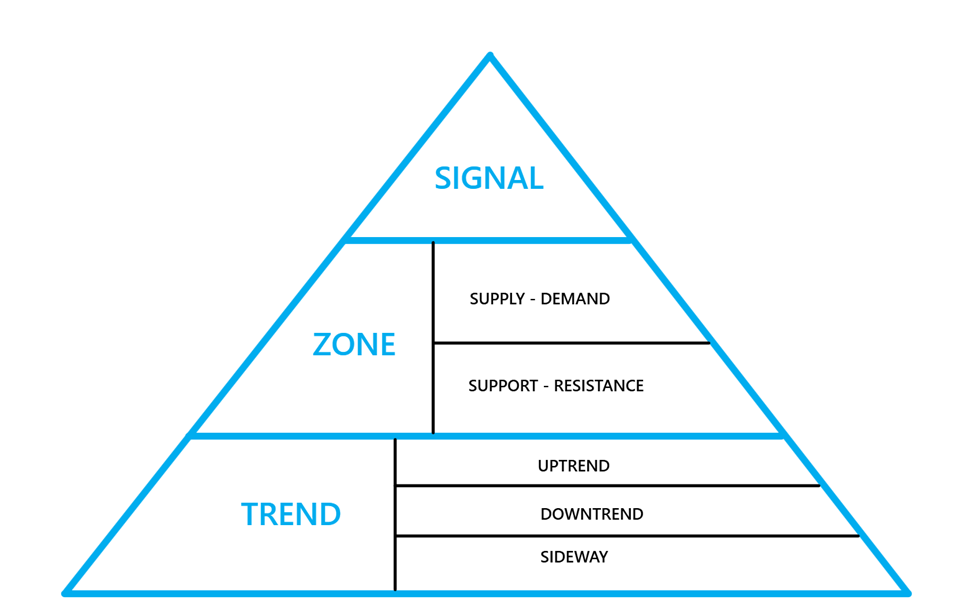

Building a trading system is like putting together a complete picture, you need to know how to put the pieces together in an order and logic.

For a trading system too, you need to have a structure of the main elements, find the right fit for the key elements then put them together in order to create a trading system.

The main elements that make up a trading system are:

1. Trend

You need to know what phase of the market you are trading: Uptrend, Downtrend, or Sideways. Choosing for yourself a phase of the market to trade will help you focus more, select signals more carefully, avoid over-trading leading to loss of control. Usually, each signal is only suitable for a certain market period.

2. Zone

You need to define the trading zone. This is very important. After determining the trend you need to trade, you must locate the area that will give the signal to trade, this will narrow the observation range, avoid sitting in front of the computer for many hours to monitor. , sitting in front of a computer for hours and staring at it will make you tired and easily fall into the trap of trading psychology. To locate the trading zone, use the Supply - Demand, Support - Resistance zones. These zones will provide trading signals, take profit and exit loss points.

In a trending market, you need to locate which phase of the trend you will be trading:

• Top of the trend

• Trend continuation

• End of trend

3. Signal

Finally, you wait for the trading signal to appear in the zone. When the signal appears, place the order.

As an example, we choose to trade in the trending market phase and not trade the sideways market. You see the picture below:

In the picture, we use the Sumo Pullback$ indicator, and the KingRenko$ candle to create a trend trading strategy.

Let's look at the 3 main factors that we incorporate:

Trend: we know that the market is trending based on Sumo Pullback$: uptrend (blue clouds forming and sloping up), downtrend (red clouds forming and sloping down).

Zone: we choose to trade in the continuation phase of the trend (pullback), wait for the price to return to the Sumo Pullback$ cloud area to give a signal. Clouds are regions. We orient to use signals when the trend continues and avoid trading at the end of the trend and the beginning of the trend as they are less reliable.

Signal: when the price returns to the cloud area, we wait for a signal from Sumo Pullback$ to place a Buy/Sell order. Stop is placed at the position above/below the signal candle, and target when there is an opposite signal.

Thus, we have built a trading system with only one indicator. You can rely on this 3 main factor structure to build your own 1 trading system suitable for yourself, you can combine many indicators to increase the identification of 3 technical factors Trend - Zone -Signal for your system.

Trading is a journey, you have to be patient to learn and the road will be open. We wish you to build the most effective trading system! See you in the next article.