How to Confidently Catch High-Probability Reversals

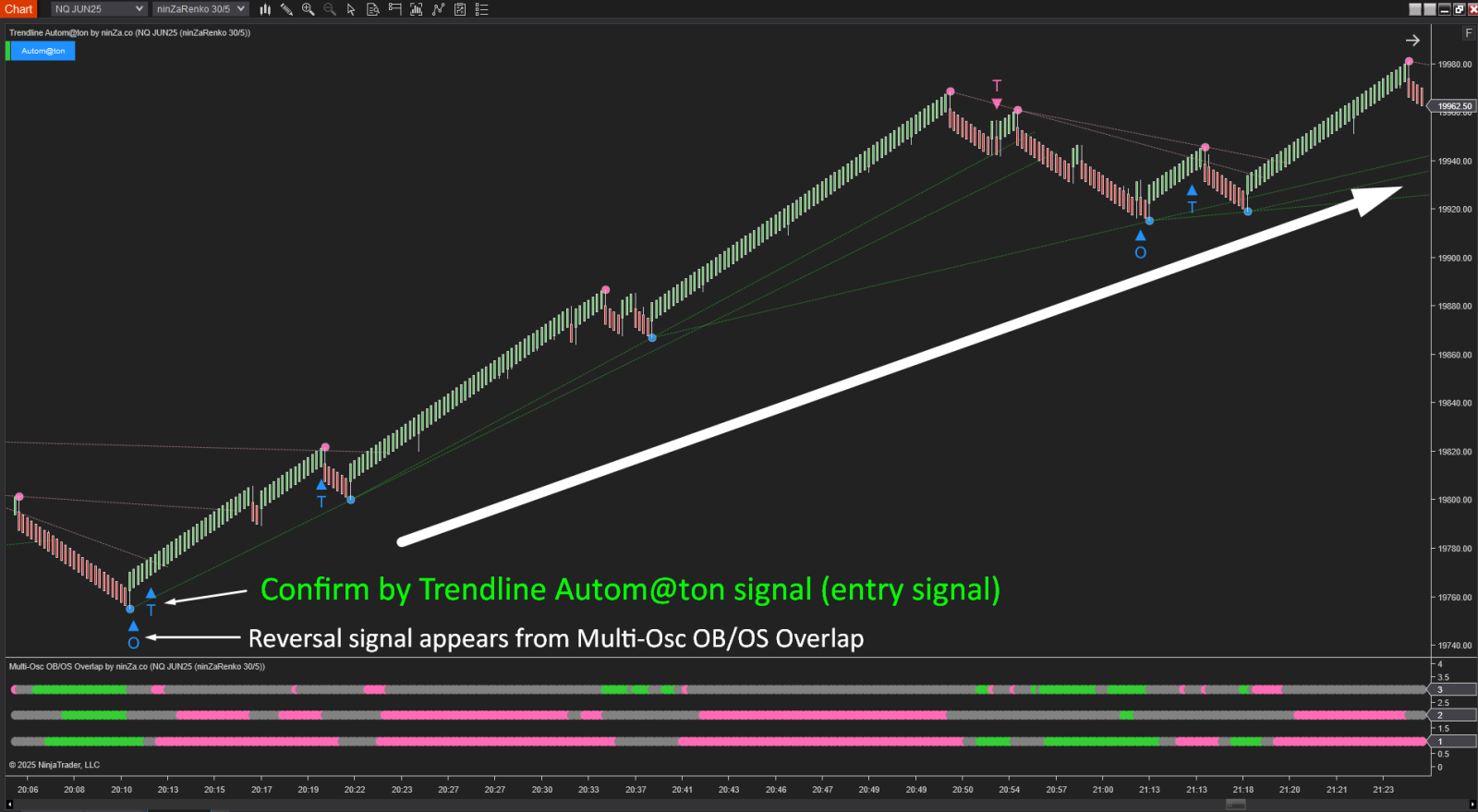

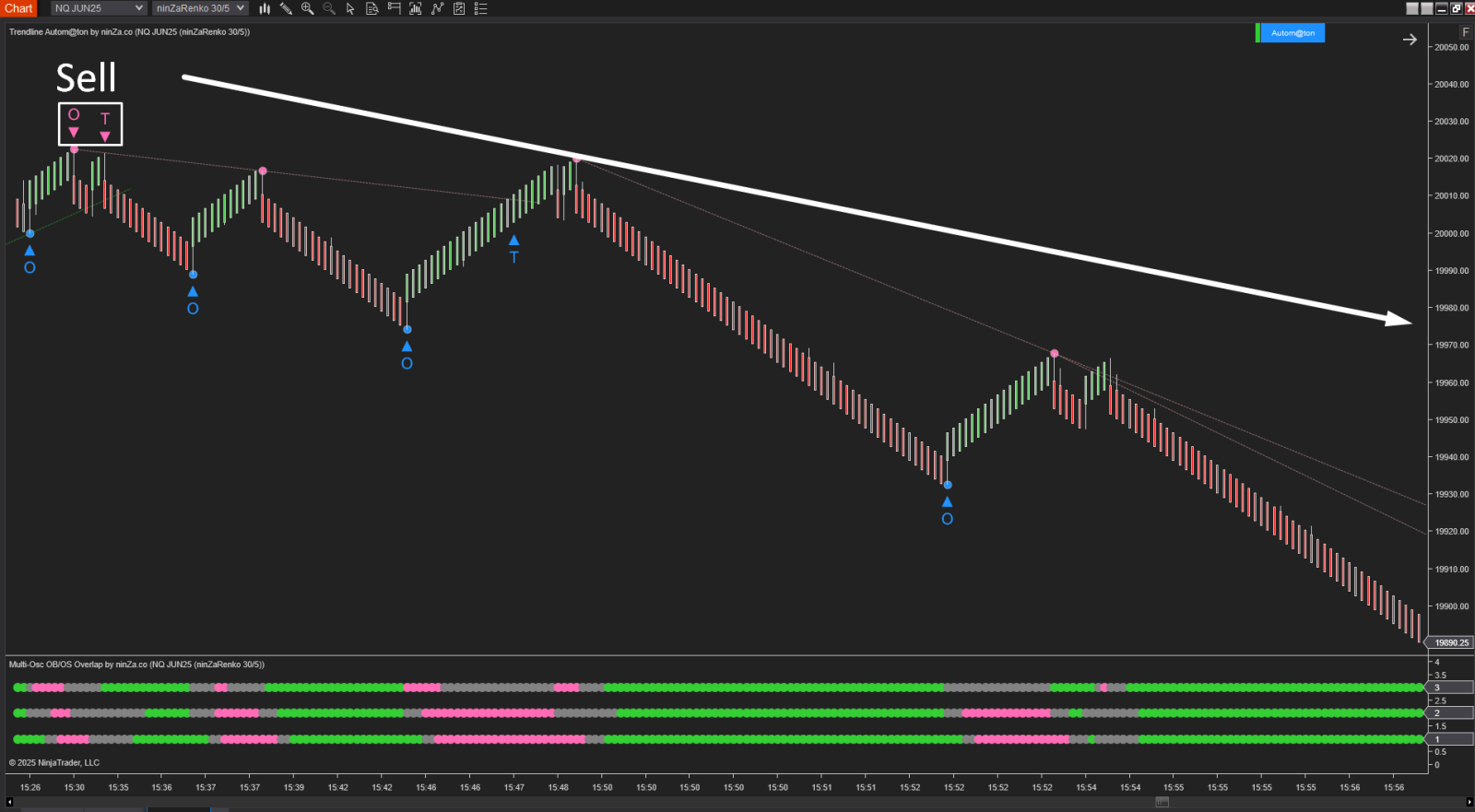

Step 1: Spot the Reversal Signal (No Entry Yet)

Start by identifying a potential reversal using the Multi-Osc OB/OS Overlap. At this stage, you are only observing — no trade should be taken yet.

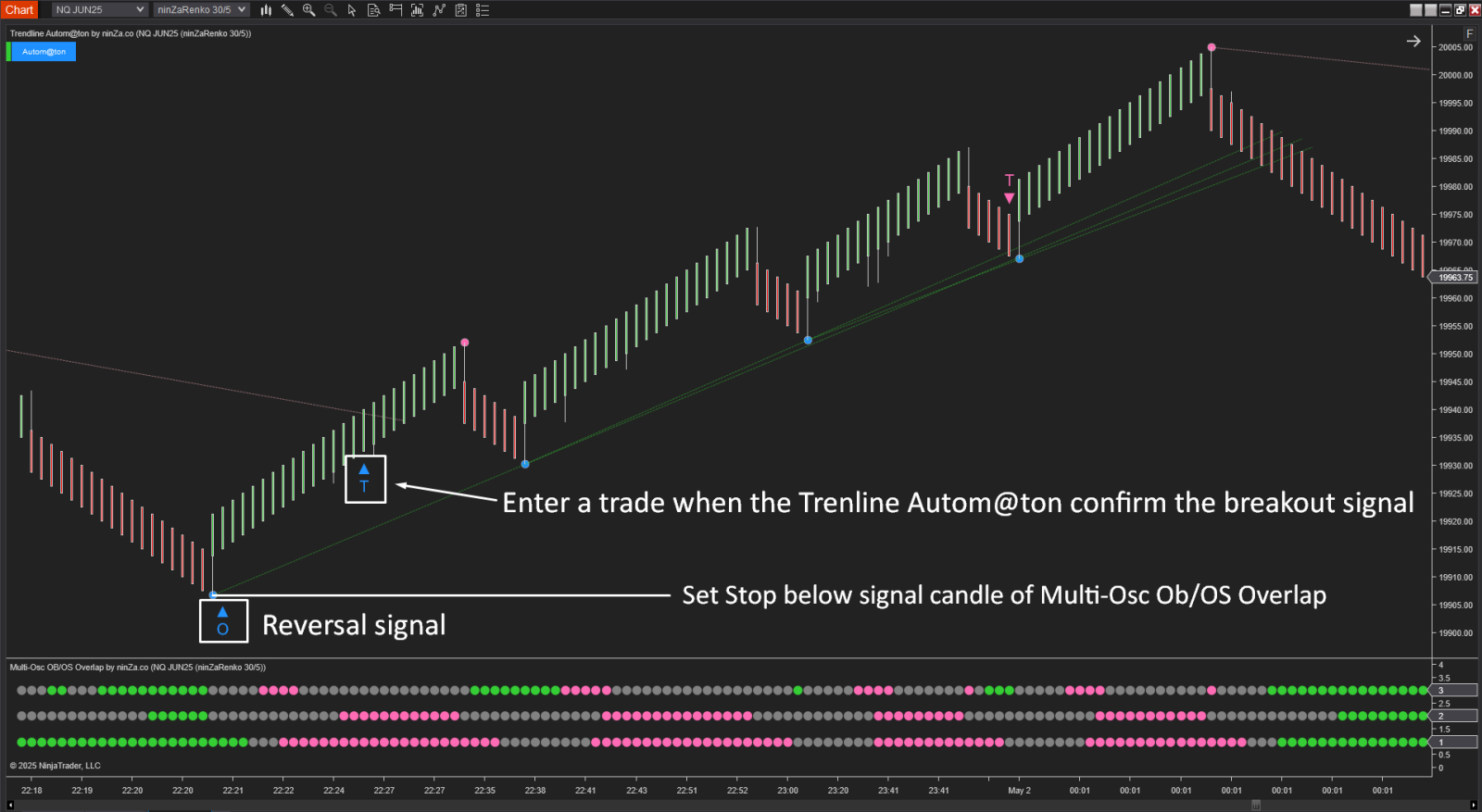

Step 2: Wait for Breakout Confirmation

A strong reversal needs to be decisive; it should break through key support or resistance levels. Use Trendline Autom@ton to automatically detect those key trendlines.

When a signal from Multi-Osc OB/OS Overlap is followed by a breakout confirmed by Trendline Autom@ton, this adds strong conviction to the trade.

Step 3: Execute the Trade with a Defined Stop

Once both confirmations align, enter the trade and place your stop loss at the candle where the Multi-Osc OB/OS Overlap signal appeared.

* Avoid Late Entries

This strategy relies on timely confirmation. If the price has already moved significantly after the initial Multi-Osc OB/OS Overlap signal and breakout confirmation hasn’t occurred, skip the trade. It’s better to wait for the next valid setup than to chase a missed opportunity.

See full video about this strategy here: