What is an Imbalance Zone? 💡

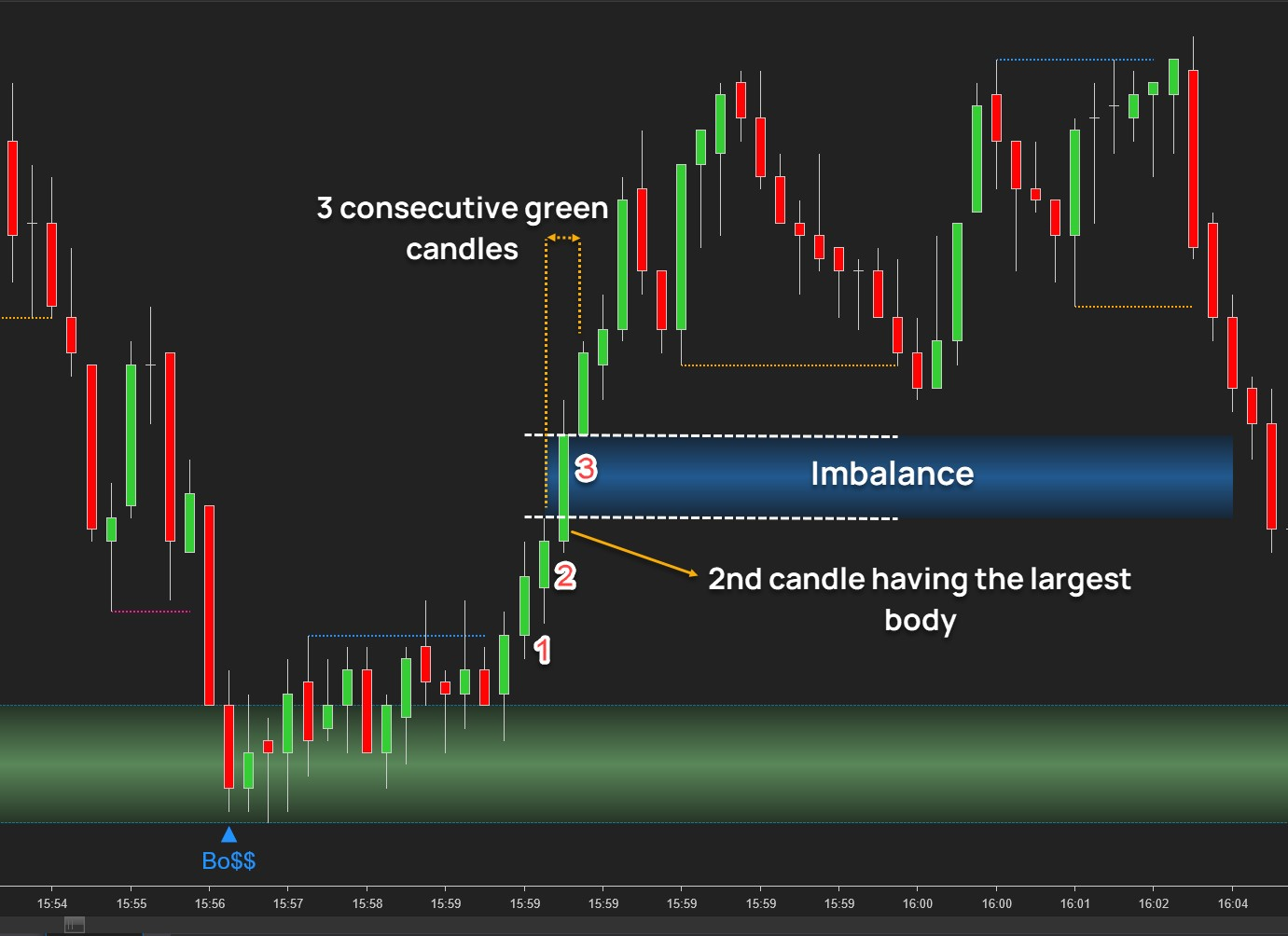

An imbalance zone is an area on the chart where either buyers or sellers were clearly stronger, causing price to move quickly in one direction, with very little resistance from the other side. For example:

- If there were many aggressive buyers and very few sellers → price jumps up quickly → this creates a buying imbalance.

- If there were many aggressive sellers and few buyers → price drops fast → that's a selling imbalance.

Later, price often comes back to these zones to "retest" or "rebalance" before continuing.

3 Reasons Why Imbalance Zones Are Highly Reliable in Trading

- Revealing Market Sentiment: When price moves fast without hesitation, that usually means either buyers or sellers didn’t show up to defend that level. That’s imbalance and it gives you a window into who’s not participating, which reveals market sentiment.

- Big Players’ Footprints: Institutions don’t enter quietly. When they place large orders, they often leave behind sharp moves and unfilled areas—what we call imbalance zones. These are the "footprints" you can track to follow their activity.

- Aligned with Market Theory: According to common market theories, price tends to revisit areas where a lot of trading interest showed up before. Imbalance zones often highlight these areas—making them great spots to watch for future reactions.

5 Common Ways to Spot Imbalance Zones

- Using Footprint Charts: These special charts show who is in control: buyers or sellers. When you see lots of buying with little to NO selling response, or the opposite, it shows a clear imbalance.

- Using Volume Profile: If you see a price area with very low volume, but price passed through it very fast, it means there was little interest from the opposite side, which is a past imbalance.

- Reading Price Action: When price moves very fast in one direction without pullbacks or hesitation, that usually means the other side wasn’t strong enough to stop it, indicating an imbalance. Price may return to that zone later to "fill the gap" or balance out.

- Watching the Order Book (DOM): If one side (buyers or sellers) suddenly places many orders or pulls their orders away, that shift can signal an upcoming imbalance.

- Tracking Market Orders: If many people are aggressively buying, and price keeps going up with no pushback from sellers, that’s a sign of a buying imbalance.

2 Indicators That Make Imbalance Zones Easy to Trade

Rather than manually scanning every chart and candle, you can use indicators designed to detect these zones in real time. At ninZa.co, we’ve developed 2 indicators that do exactly that, each based on a different approach to imbalance detection.

Imbalance Volume Sensor

(Built on Footprint Logic)

Imbalance Volume Sensor uses advanced order flow analysis to detect true imbalance zones, which are areas where one side of the market is entirely absent. It goes deep into tick-level data to reveal where either buying or selling pressure completely disappears.

The indicator identifies 2 key types of zones:

- Overall Imbalance Zones, where a dominant buy or sell imbalance exists across multiple candles.

- Absolute Imbalance Zones, where the absence of one side reaches an extreme level, helping you fine-tune entries or scale larger positions with greater precision.

Imbalance Profile Lidar

(Built on Price Action Principles)

Imbalance Profile Lidar automatically detects volume concentration zones using price action and imbalance phases. No manual drawing required. It identifies key value areas, POC zones, and imbalance signals to reveal where buying or selling pressure dominates.

By combining price action with volume profile logic, it helps you:

- Spot imbalance zones that often precede sharp price moves

- Understand who’s in control, buyers or sellers, within specific price ranges

- Receive trading signals based on volume concentration and price behavior.

Both indicators aim to do the same thing: Help you detect imbalance zones that carry weight. The difference lies in the lens you prefer: volume-based insight or price-based clarity.

Whatever your trading style, learning to work with imbalance zones can give you an edge, not by predicting the future, but by understanding the footprints of intent that the market leaves behind.