Many traders pay close attention to win rate, whether it's the win rate of a strategy, an indicator, or a complete trading system. It's often used as a key measure of effectiveness. But does a high win rate always mean the method is reliable? And does a low win rate automatically mean it's not worth using?

In this blog, we’ll dig into how win rate is determined, what it does (and doesn’t) tell us, and why it’s not the full story when it comes to evaluating trading performance.

How Do You Measure Win Rate?

There are 2 common ways traders determine the win rate of a method:

1. Backtesting

Backtesting allows traders to apply their strategy or system to historical market data to see how it would have performed. Popular platforms like NinjaTrader 8 offer tools like the Strategy Analyzer, which runs automated backtests over selected timeframes. However, the catch is that Strategy Analyzer requires a fully automated strategy built through Strategy Builder, which can be complex and time-consuming to set up.

For traders who want a quicker and easier method, tools like HelloWin provide a much simpler way to backtest. You don’t need to build a full automated strategy, just define your logic, run the test, and get the results.

2. Simulated Trading or Playback Testing

Another method is to manually test your system using a Sim account or the Playback feature. This allows you to run through historical market data as if you were trading in real time and collect your win/loss results from there.

The Limitations of These Methods

While both approaches can be helpful, they also have limitations.

- Backtesting on platforms like NT8 usually runs with fixed ATM strategies. That means you can’t adjust stop losses mid-trade or apply advanced risk management techniques. This can skew the real effectiveness of the system, especially for discretionary traders.

- Simulated trading, while closer to real execution, still lacks one critical factor: psychology. When trading on sim or in playback mode, you're not under the same emotional pressure you face in live markets. That means your results, especially your win rate, might not reflect what would happen in a real-money environment.

So, Is Win Rate Important?

Yes and no! It’s natural to assume that the higher your win rate, the more profitable your strategy is. But that’s not always the case.

Let’s look at 2 examples:

| Example 1 | Example 2 |

|---|

| Risk-Reward Ratio: 1:5 | Risk-Reward Ratio: 5:1 |

| Total trades: 5 | Total trades: 13 |

| Wins: 1 | Wins: 10 |

| Losses: 4 | Losses: 3 |

| Low Win Rate: 20% | High Win Rate: 77% |

| Profit: One win = +$500, four losses = -$400 | Profit: Ten wins = +$500, three losses = -$1,500 |

| Net profit = +$100 | Net loss = -$1,000 |

As you can see, a low win rate strategy can still be profitable if the reward outweighs the risk. And a high win rate strategy can still end in losses if just a few losing trades wipe out the gains.

The Hidden Pitfall in Backtesting Win Rate

A critical mistake many traders make is judging a strategy’s quality only by its backtested win rate. But this number can be misleading. Backtests usually assume fixed stop-loss and take-profit levels. This means they can’t account for dynamic trade management like trailing stops, partial exits, or manually closing trades when market conditions change.

For example, price might move in your favor, almost hit your TP, then reverse and hit SL. The backtest logs a loss, but in a live trade, you may have adjusted the SL or taken early profit—turning it into a winning or breakeven trade.

And while simulated trading (e.g. Playback or SIM accounts) offers a bit more control, it still lacks one major component of real trading: psychology. Without emotions like fear or hesitation, simulated trading tends to overestimate execution quality and consistency, leading to win rates that aren’t always realistic.

Let’s take Super JumpBoo$t as an example.

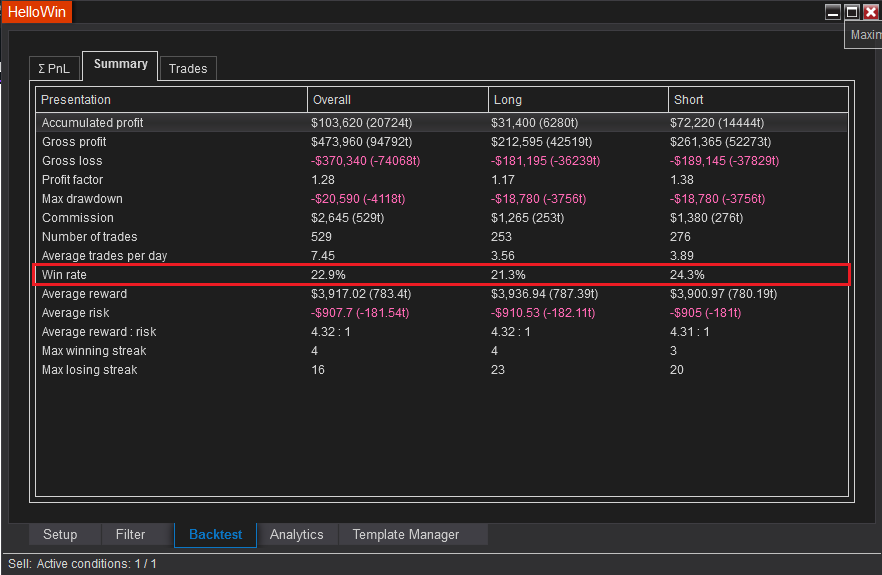

Its backtest result shows a win rate of 22.9 %. On paper, that might raise concerns. But in real trading, by adjusting stops and actively managing positions, the win rate can climb to 70%—a huge difference driven by live decision-making, not by changing the strategy itself.

Here’s a snapshot from the backtest:

And now, compare it with this live trading video using the same strategy:

This illustrates the main point: Win rate is not fixed. It’s shaped by how you trade.

Final Thoughts: What Really Matters

So, is win rate important? Yes, but not in the way most people think.

Win rate is just one piece of the puzzle. You also need to look at risk-to-reward ratio, trading psychology, position sizing, and adaptability. A low win rate strategy can still be highly profitable if the winners are big enough. On the flip side, a high win rate strategy can fail if losses are too large or gains too small.

More importantly, win rate is NOT fixed. It’s shaped by how you trade. Your execution, your psychology, and your ability to adapt matter just as much (if not more) than the raw number in a backtest report.

In the end, win rate is a starting point, not the final word!