In the dynamic world of trading, understanding market structure is key to making informed decisions. One of the most essential skills is identifying swing points (also known as pivot points). So, what exactly are swing points and why are they so crucial?

📊 What Are Swing Points?

Swing points are significant highs and lows on a price chart that help determine whether the market is in:

Uptrend: Higher highs and higher lows

Downtrend: Lower highs and lower lows

Sideways (ranging): Highs and lows are roughly equal or show minimal deviation, and they typically move within an upper and lower boundary range.

Beyond trend identification, swing points are vital for detecting support and resistance zones—areas where prices are likely to reverse or pause.

🔍 2 Main Methods to Identify Swing Points

Method 1: Candle-Based Identification

This is the most intuitive and visual method.

A swing high is a candle that has the highest price compared to N candles before and N candles after it. A swing low is the opposite.

✅ Advantages:

Easy to spot: Visually identifiable by looking at the chart.

Visual: Clear representation of price structure.

Great for scalping: Produces frequent signals, suitable for short-term trades.

❌ Disadvantages:

Timeframe-sensitive:

A swing point on a 1-minute chart may not appear on a 15-minute chart, even though they occur at the same moment.

➡️ This happens because the 15-minute candle is still forming—the swing hasn’t been confirmed yet.

➡️ One 15-minute candle can contain many small swing points from the 1-minute chart. These are not “wrong”—they’re just part of the ongoing price action inside a longer candle.

Can generate noise: More signals also mean more minor, less meaningful swings.

Best for: Scalpers and short-term traders looking for quick entries and exits.

Method 2: Price Change-Based Identification

This method focuses on actual price movement rather than candle patterns.

- A swing high is confirmed only if the price drops by N ticks/pips after a peak.

- A swing low is confirmed only if the price rises by N ticks/pips from a bottom.

✅ Advantages:

Consistent across all timeframes: A swing point detected here is identical on any chart—minute, tick, Renko, etc.

Filters out noise: Only significant movements are captured, great for swing traders.

❌ Disadvantages:

Fewer signals: Requires a minimum price move, so small swings may not appear.

Less visual: Often requires software or tools to confirm swing points.

Best for: Swing traders and multi-timeframe analysts seeking major turning points.

🧠 Why Timeframes Matter: A Quick Example

Let’s say you’re watching a 1-minute chart. You might see a swing high already form. But on the 15-minute chart, that same price action is still forming part of a single, unfinished candle.

So:

✅ The 1-minute chart confirms the swing quickly because the candles are complete.

❌ The 15-minute chart won’t show the swing until that candle closes—which may or may not result in a confirmed swing point.

🔁 A single 15-minute candle can contain many 1-minute swing points. The swing logic is the same—but the confirmation timing depends on the candle closing.

🛠️ The Right Indicators for Each Method

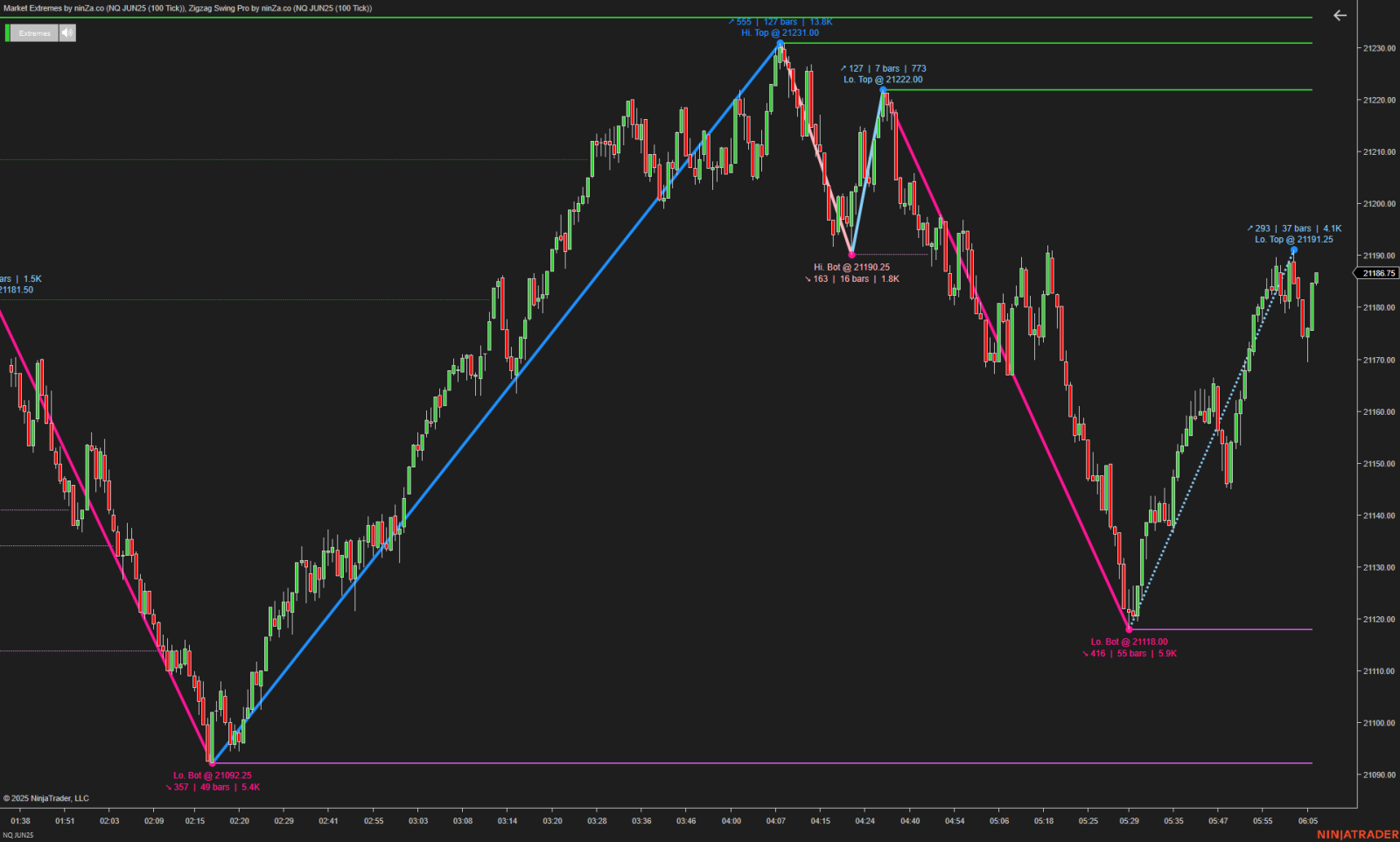

Market Extremes — For Candle-Based Method (Method 1)

A powerful tool that marks market tops and bottoms using candle rules:

Tops: Not lower than highs of N bars left and M bars right

Bottoms: Not higher than lows of N bars left and M bars right

Levels remain intact until broken by a close.

Customize the “age” of a level to filter significant zones.

Smart Level Thickness: Thicker lines = older, stronger levels.

Alerts when price nears any level within X ticks.

Perfect for: Traders who want fast, visual signals — especially scalpers.

Zigzag Swing Pro — For Price-Based Method (Method 2)

Built on an advanced zigzag algorithm that solves the biggest swing detection issues:

✅ Consistent across timeframes

✅ Minimum Swing Length setting in ticks or ninZaATR

✅ Displays full swing info: length, volume, retracement, duration, type

✅ Marks Double Tops, Lower Highs, etc.

✅ Shows Active & Inactive Support/Resistance levels

🎯 Ideal for: Traders needing high-confidence swing points for larger timeframes or multi-timeframe analysis.

📈 Choosing the Right Method (and Indicator)

| Trader Type | Best Method | Recommended Indicator |

|---|

| Scalper | Candle-Based | Market Extremes |

| Swing Trader | Price-Based | Zigzag Swing Pro |

🎁 Special Offer

Upgrade your trading with Zigzag Swing Pro and Market Extremes to unlock deeper insights into market structure.

Use code “METHOD56” to get 56% OFF each today! (comes with a $100 voucher included)

💎 Zigzag Swing Pro: https://ninza.co/product/zigzag-swing-pro?src=hellowin

💎 Market Extremes: https://ninza.co/product/market-extremes?src=hellowin