1. "What is KingRenko$?"

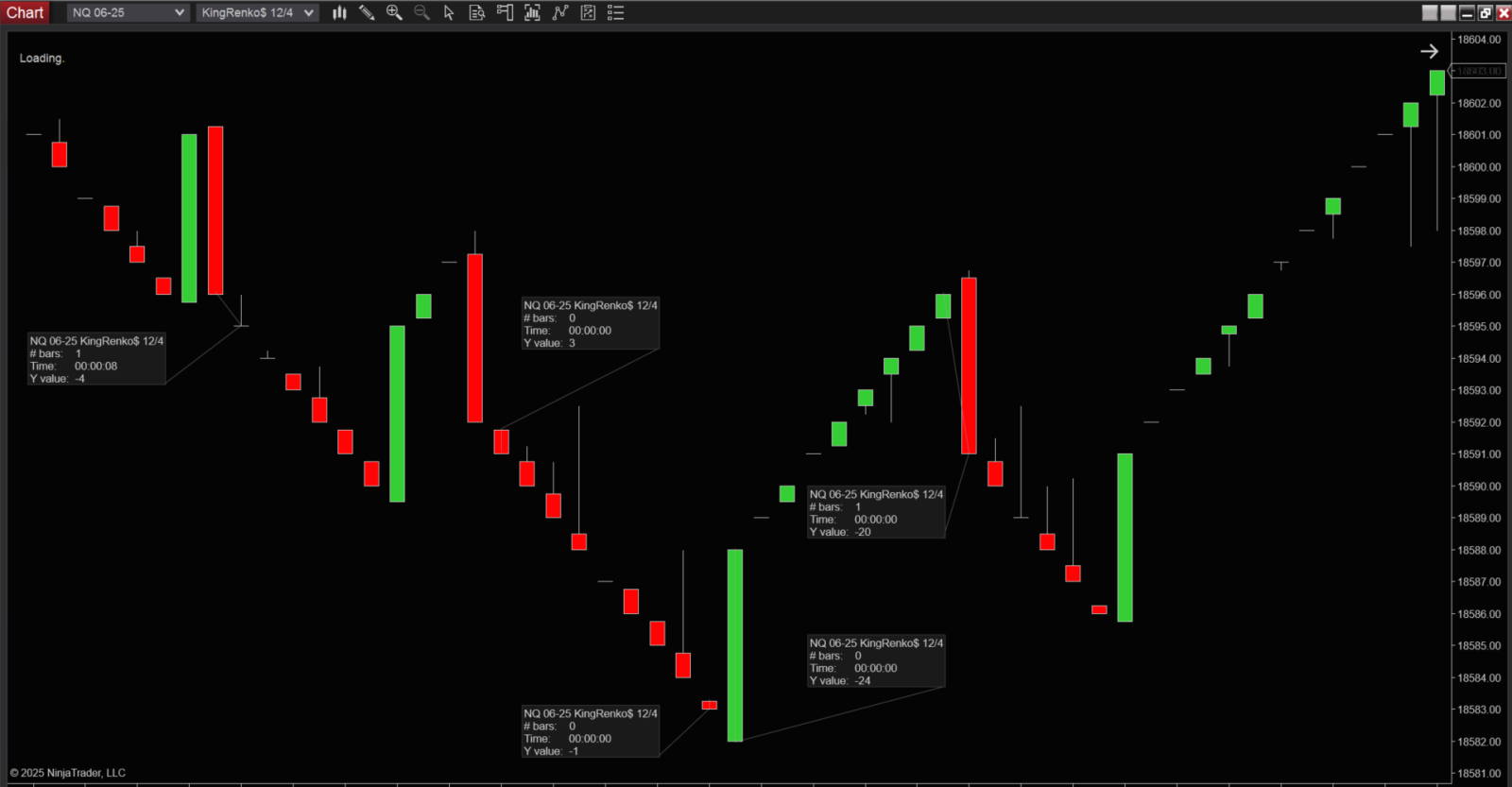

→ KingRenko$ is a Renko bar type for NinjaTrader 8 that uses real market data without any artificial open.

It shows the true OHLC values of each bar, giving you accurate price representation and full transparency.

2. "How is KingRenko$ different from ninZaRenko?"

→ While ninZaRenko uses an artificial open to create balanced bricks between bullish and bearish candles (making trend visualization smooth), KingRenko$ removes that artificial element.

What you see is 100% real market data, making it suitable for accurate backtesting.

3. "Are the settings the same as ninZaRenko?"

→ Yes. KingRenko$ uses the same parameters:

- Trend Threshold

- Brick Size

This makes switching between the two bar types seamless.

4. "Why choose KingRenko$ over ninZaRenko?"

→ If you need precise backtesting, KingRenko$ is the clear choice.

Without artificial opens, it reflects true market behavior, helping you evaluate and refine strategies with confidence.

5. "How do I adjust the open offset to get the smooth price action I am looking for with your bar type? Is that 12/4 ratio exactly equivalent to a reversal percentage of 300%?"

→ With KingRenko$, there are just 2 parameters: Brick size and Trend threshold. The 3rd parameter, open offset, has been removed because this bar type auto-adjusts it to ensure the best symmetry for both uptrends and downtrends.

6. "If I were using your bar type, what with the settings look like as a counterpart?"

→ If you want the KingRenko$ settings to match LogikUltimateRenko 50/5/250, I think we can use KingRenko$ 50/5. I’ve attached 2 images for you to compare ninZaRenko and KingRenko$ with LogikUltimateRenko.

Note: The ratios of these 2 bar types are the same, but they differ in appearance. While KingRenko$ is for real open, ninZaRenko is for fake open.

7. "I assume that means every 4 ticks in the trend direction create a new bar, but it takes 12 ticks in the opposite direction to change bar color and trend direction?"

→ Yes, you're right! The 1st part is correct: "Every 4 ticks in the trend direction creates a new bar". But the 2nd part is incorrect because:

The reversal candle needs 20 ticks to form, calculated by this formula:

- Reversal candle = (brick size * 2) - trend threshold = (12 * 2) - 4 = 20 ticks.

8. "Do you have any screenshots of the parameters and property panel line items that can be edited?"

→ You can refer to the settings for this bar type and how to set it up here:

9. "I am assuming these smaller bars (on a 12/4 setting) mean that smaller bars will have a maximum size of 4 ticks?"

→ The size of the smaller candle after the reversal candle is calculated using this formula:

- Bar size = trend threshold - gap = 4 - 1 = 3 ticks.

So, the maximum size of the bar is 3 ticks.

10. "But why in the top picture is the spacing between the end of one bar and the beginning of the next so wide?"

→ This happens because the market is gapping and there's a lot of volatility. For example:

If the market gaps 3 ticks, this will display as 3 ticks.

If the market is running smoothly, it will display as 1 tick.

Since KingRenko$ uses real open, you’ll see the gap and the space created by it.

Tip: If you see a large gap, the market is highly volatile, but 1 tick is normal.