When trading, setting effective Stop Loss and Target points is crucial for managing risk and maximizing profits.

1. What is ATR?

The Average True Range, developed by J. Welles Wilder Jr., is a technical analysis indicator that measures market volatility. Unlike indicators that focus on price direction, ATR quantifies the degree of price fluctuation over a given period. It calculates the average of the “true ranges” over a specified period (typically 14 periods). The “true range” considers the greatest of the following:

Current high minus the current low.

Absolute value of the current high minus the previous close.

Absolute value of the current low minus the previous close.

By considering these 3 possibilities, ATR captures volatility even when gaps exist between trading days or during limit moves.

2. Why Traders Choose ATR ?

Using ATR is a popular and trusted method among professional traders for several key reasons:

Objective Measurement of Market Volatility

ATR measures the average price volatility over a set period. This helps traders understand the typical price movement range, allowing them to set Stops and Targets that are neither too tight (causing premature stop-outs) nor too wide (leading to inefficient trades).

Customization per Asset

Each asset has its own characteristic volatility. ATR enables you to tailor Stop and Target levels based on the actual volatility of the specific stock or instrument, instead of using a fixed, one-size-fits-all distance.

Reduces Noise Impact

Setting Stop Loss based on ATR values above normal price fluctuations helps avoid being stopped out by minor, irrelevant market “noise” or fake price swings.

Guides Risk/Reward Ratio

Traders can define Stop Loss distances as multiples of ATR and set profit Targets as multiples of ATR as well, building a clear and scientific approach to risk management with balanced risk/reward ratios.

3. How our ATR-TradeShield supports your trading ?

ATR-TradeShield is an advanced auto trailing stop system, designed for automatic and dynamic risk management, so you can trade smarter, stay consistent, and save time.

🔧 What ATR-TradeShield can do for you:

✅ Dynamic Stop/Target placement using customizable ATR multiples (e.g., 2×ATR, 3×ATR)

✅ Supports up to 3 Stop/Target levels per trade — perfect for scaling in/out

✅ Auto-adjusts Stops and Targets as price moves — no need to update manually

✅ One-click control to auto merge or split your Stop/Target levels

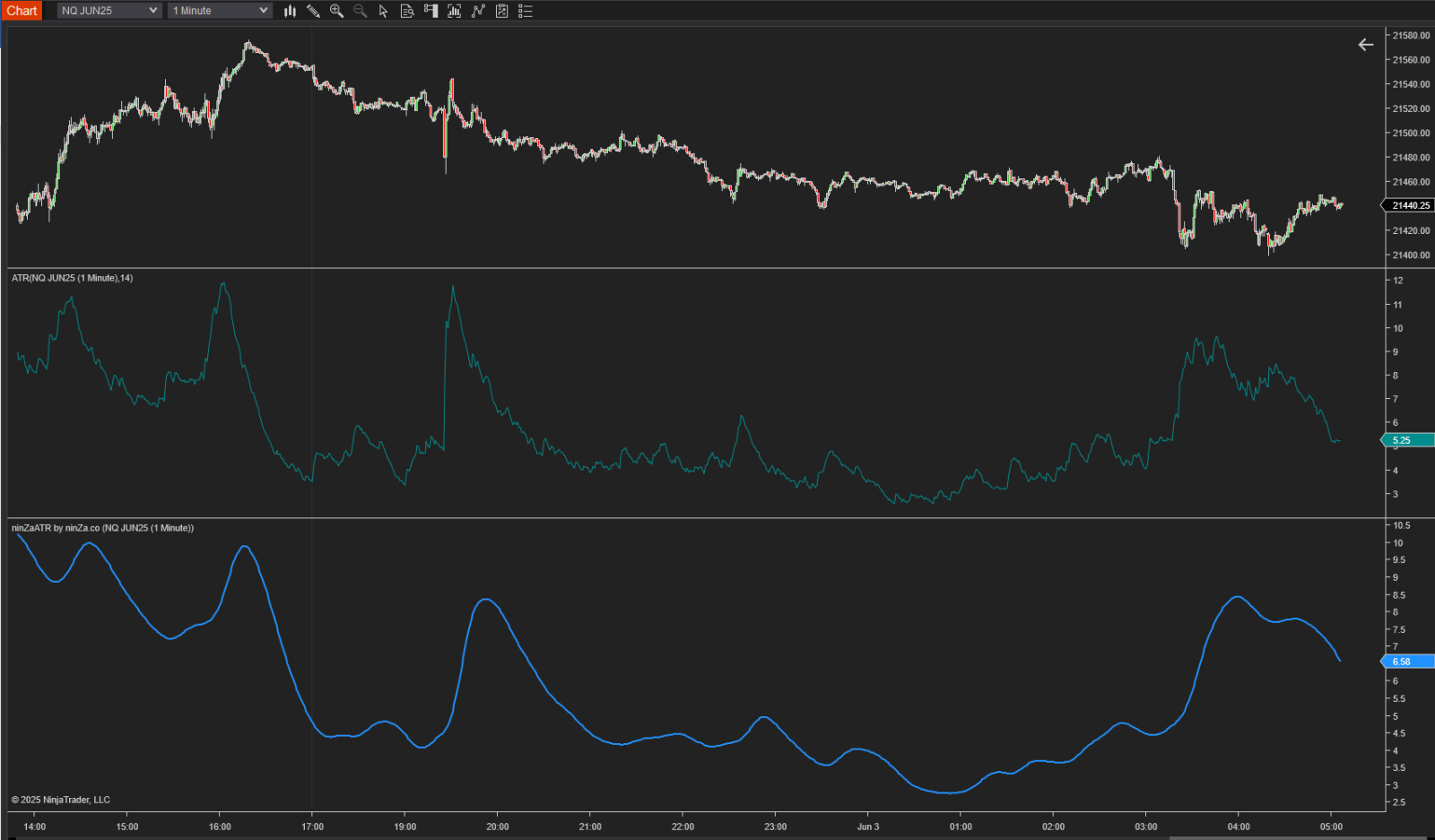

✅ Choose between classic ATR or the enhanced, flexible ninZaATR

With ATR-TradeShield, your risk management becomes automated, adaptive, and disciplined - helping you focus more on strategy and less on micromanaging trades.

If ATR-TradeShield is exactly what you’ve been looking for, feel free to visit my personal store to grab this cool tool at the best price:

👉 https://gracetrading.io/