Order Blocks are key zones where large traders (whales) place orders, leading to price reversals. For Swing Traders, identifying these Order Blocks is crucial to catch potential market reversals. Order Blocks are key zones where large traders (whales) place orders, leading to price reversals.

For Swing Traders, identifying these Order Blocks is crucial to catch potential market reversals. KingRenko charts make this process clearer by focusing on price movement and removing the time factor, making it easier to spot areas of interest with greater accuracy.

Here’s a step-by-step guide on how to identify Order Block on KingRenko$:

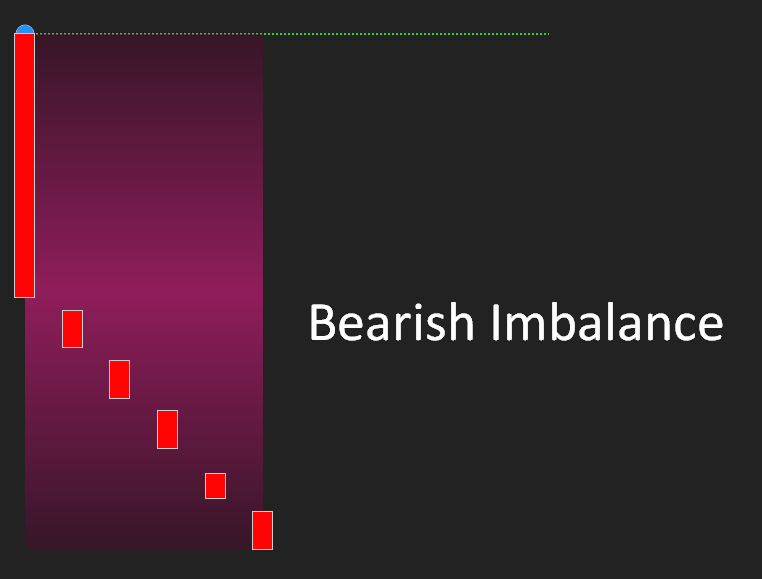

Step 1: Identifying Imbalance

Imbalance is one of the key signs left by whales after entering a trade. When whales enter the market with large order volumes, there might not be enough counter-orders to match their positions, causing an imbalance between supply and demand. This imbalance creates price gaps that may lead to reversals.

On KingRenko$ charts, you can spot an imbalance when you see consecutive large candles with no wicks (tails). These candles indicate a weak presence from the opposing side, showing that the market is being pushed in one direction by a large trader.

To identify an imbalance on KingRenko$, you need to see at least (x) consecutive candles without wicks to confirm the presence of a significant order imbalance. This helps increase the reliability of identifying areas where whales are likely active.

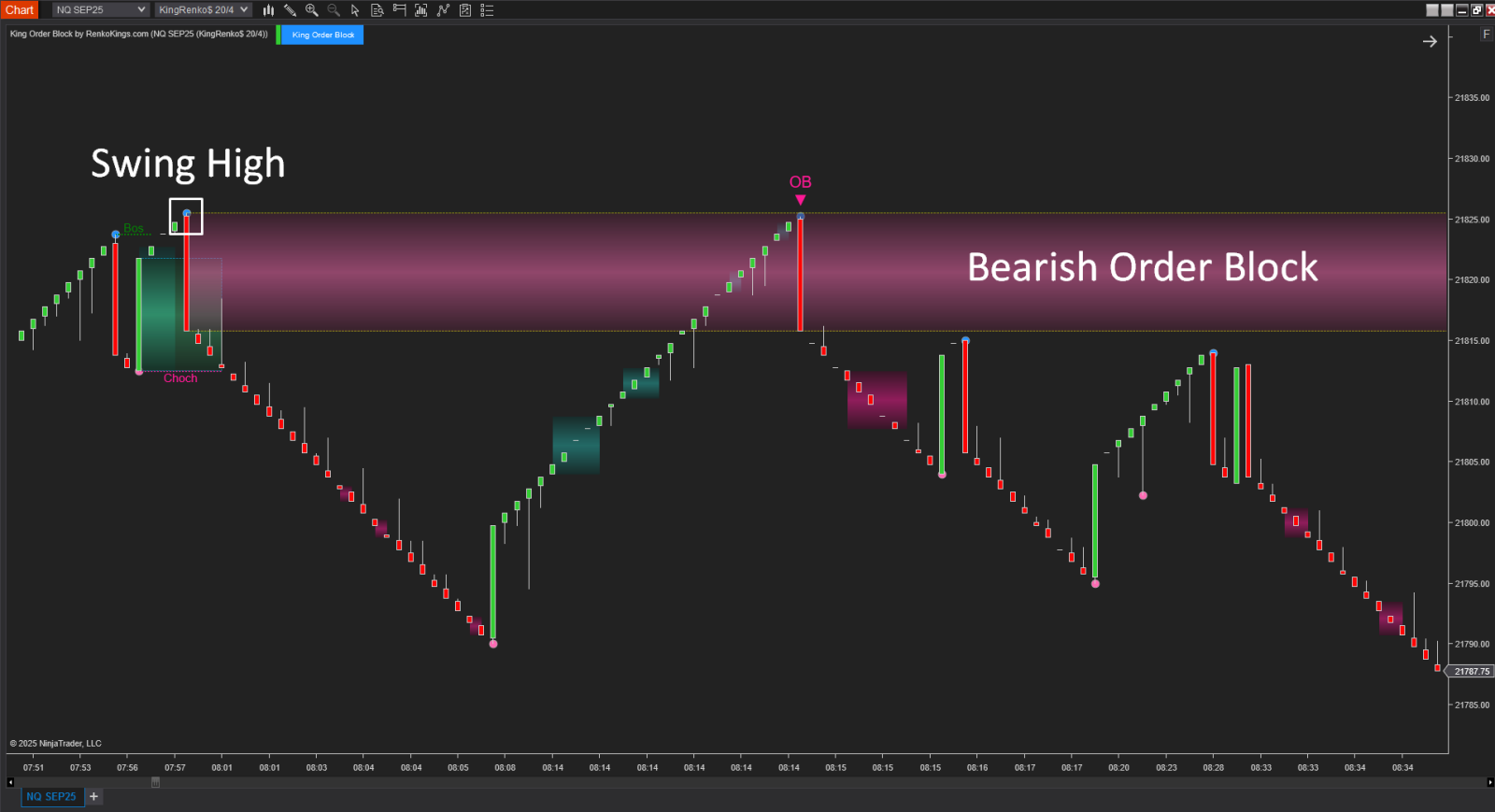

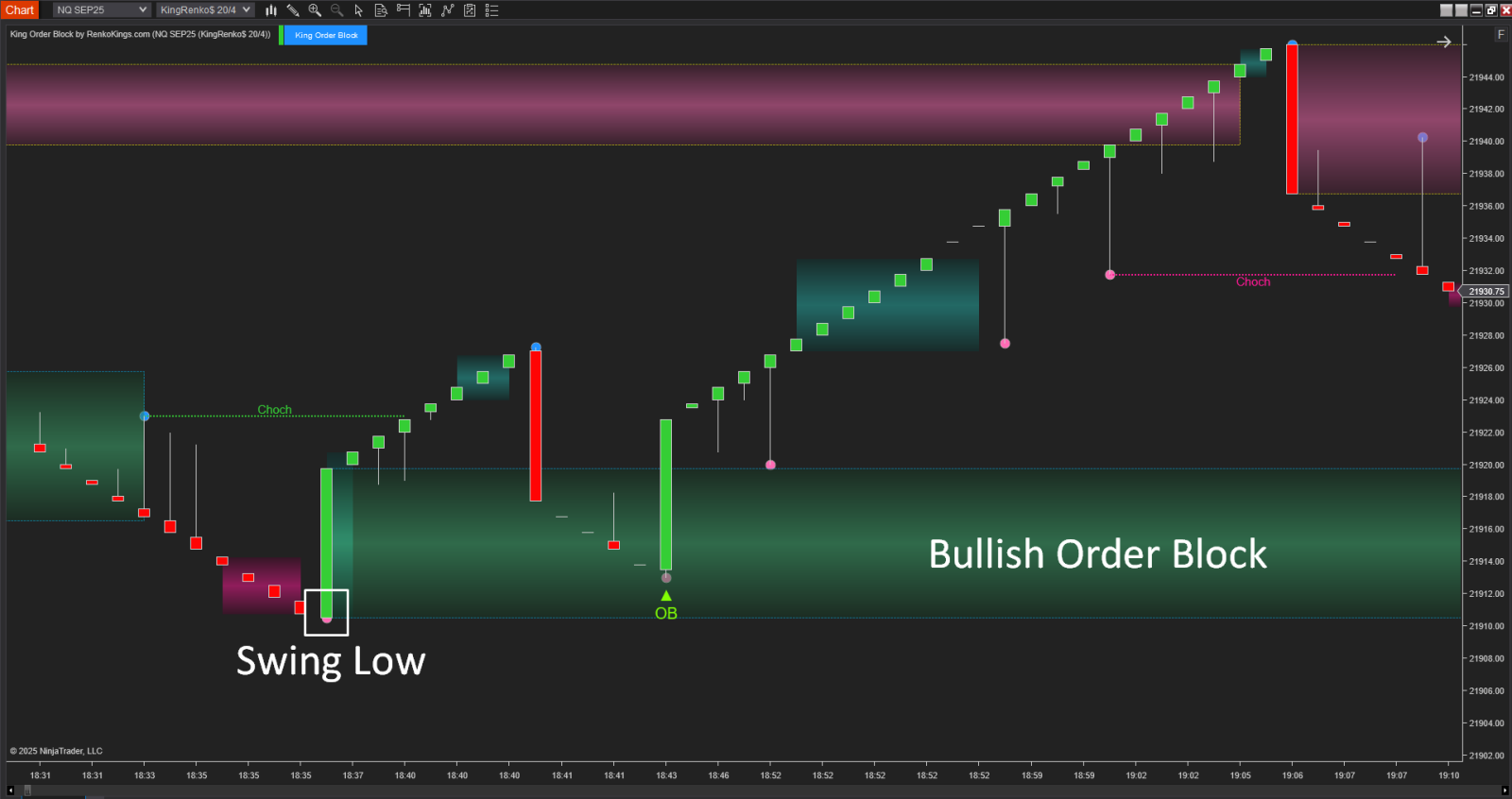

Step 2: Identifying BoS and CHoCH

In technical analysis, BoS (Break of Structure) and CHoCH (Change of Character) are essential concepts to recognize market shifts.

BoS (Break of Structure): This occurs when price breaks through previous highs or lows, signaling the continuation of the current trend.

CHoCH (Change of Character): This occurs when the market structure shifts from an uptrend to a downtrend or vice versa, signaling a potential trend reversal.

Identifying BoS and CHoCH is important because they often happen when whales push the market in a significant direction, creating new highs or lows. These events are key in identifying potential Order Block areas, as they highlight moments when the market is about to change direction or continue in its trend.

Step 3: Identifying Swing Points

Order Blocks are typically defined by the last bullish or bearish candle before a reversal, known as Swing Points. On KingRenko$, Swing Points are easier to identify as they appear as clear price reversals. These are the candles that signify the turning point before the market changes direction, whether up or down.

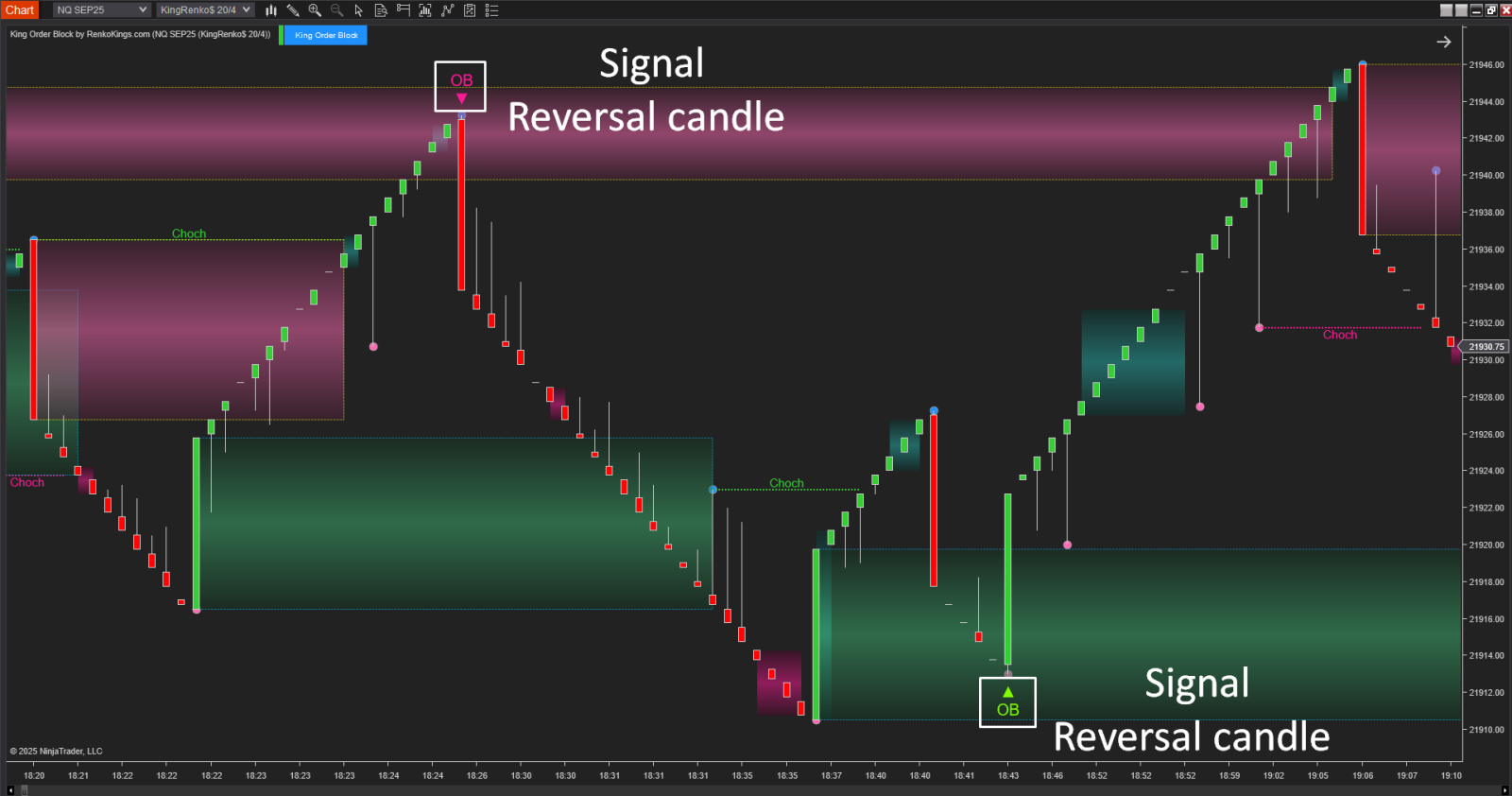

Step 4: Identifying Entry Signals

Once you've identified the Order Block, the next step is to look for price to return to this zone and see if a reversal signal appears. On KingRenko$ charts, this is often signaled by another strong reversal candle. When price revisits an Order Block and a reversal candle forms, it provides a strong entry signal.

Because KingRenko$ eliminates the time factor and focuses solely on price movements, the signals are much clearer and less affected by market noise. This allows you to make more reliable trading decisions based on the price action at the Order Block.

Conclusion

Order Blocks are essential for Swing Traders, as they mark potential reversal points in the market. By using KingRenko$ charts, you can easily spot imbalances, BoS, CHoCH, and Swing Points to accurately identify Order Blocks. This method helps you trade with more confidence and precision, taking advantage of price reversals with greater accuracy.

You can refer to the King Order Block indicator here: https://renkokings.com/product/king-order-block

Detailed explanation video about King Order Block: