💥 Catching Reversals Isn’t Hard

If you truly understand which trend is reversing – and what the real signals are.

Many traders lose money by entering reversal trades too early.

But the truth is, they’re not wrong for choosing to trade reversals –

they’re wrong because they don’t know which trend is actually reversing.

❌ Reversal is not about "buying the bottom" – it's about a true trend transition

A true reversal means: One trend ends, and a new one begins.

So… what kind of reversal are you expecting?

This question is critical.

🔍 3 Trend Levels in Dow Theory – and the most common mistake

A trend is the directional movement of price over a period of time.

It has momentum, structure, and its reversal signs are often complex and misleading.

According to Dow Theory, trends are structured in 3 distinct layers:

| 🧱 Trend Level | Description | Reversal Characteristics |

|---|

| 🟠 Primary Trend | The dominant, long-term direction | Strong momentum but relatively easier to identify. Reversals may lead to a new Secondary trend or an entirely new Primary trend. |

| 🔵 Secondary Trend | Moves against the Primary trend, but within the same level | Moderate momentum, more complex signs. Reversals here often signal the start of a new Primary trend. |

| ⚫ Minor Trend | Small, short-term fluctuations | Highly noisy and misleading. Most reversals here are simply minor pullbacks |

🧠 From my experiences:

If you’re trading pure reversal strategies, focusing on Primary trend reversals gives the best balance between accuracy and reward.

✅ It’s not about how many signals you see – it’s about identifying the right trend layer.

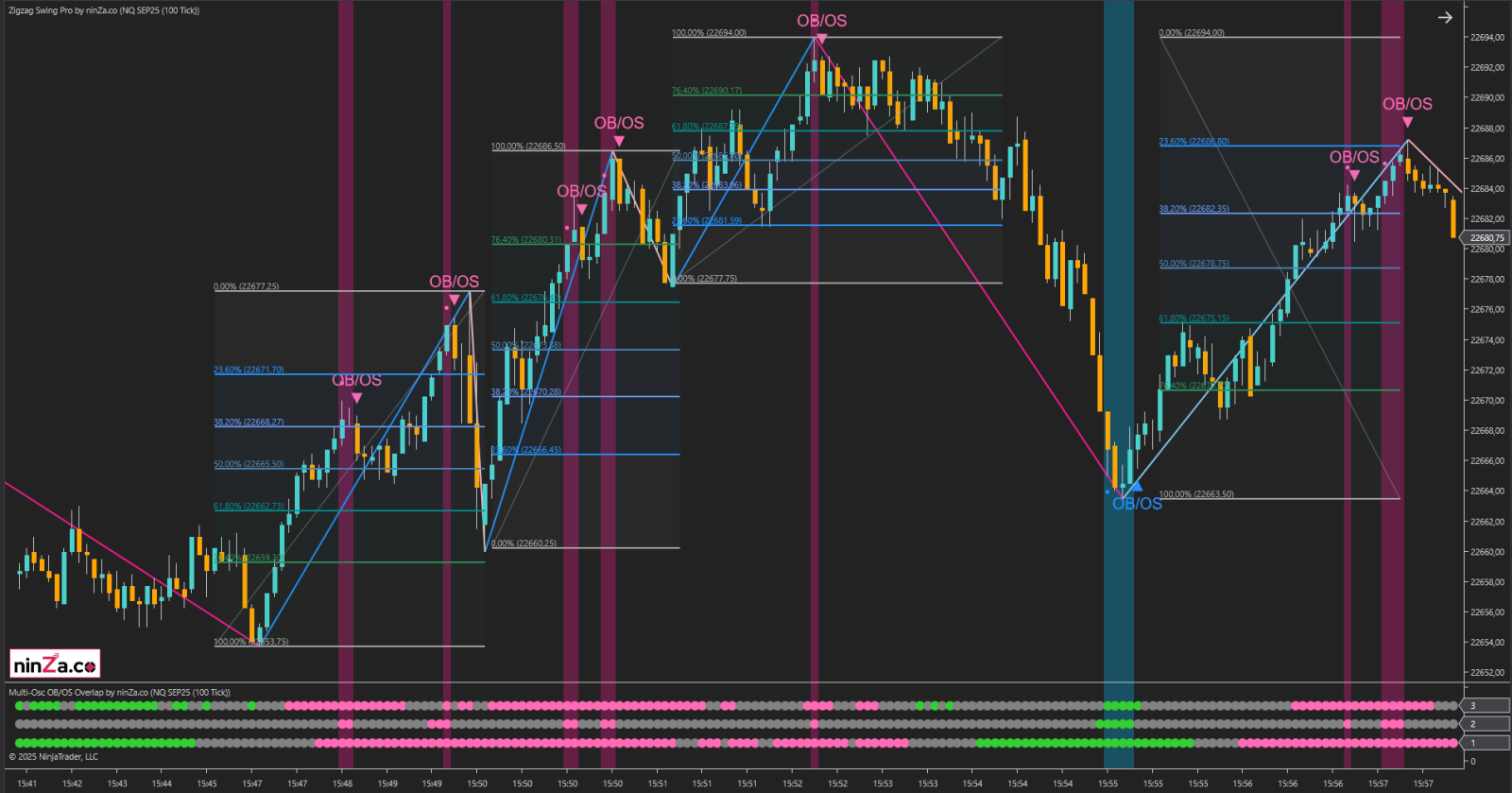

That’s exactly what Zigzag Swing Pro + Multi-Osc OB/OS Overlap is designed to do.

🔹 Zigzag Swing Pro – A powerful trend-layer visualization tool

Displays clear trend structures using swing highs and swing lows

Helps you instantly recognize Primary, Secondary, and Minor trends

Most importantly: tells you which reversal is worth taking, and where to set your target

📌 Here’s how I apply it in real setups:

| Market Structure | Strategy | Fibo Target |

|---|

| Strong uptrend | Avoid reversals | 0.236 – 0.382 |

| Weakening uptrend | Selective reversal entries | 0.5 – 0.618 |

| Sideways | Prioritize reversal setups | 0.618 – 0.786 |

🔹 Multi-Osc OB/OS Overlap – A smart multi-layer reversal filter

Uses RSI to confirm the Primary trend direction and identify exhaustion

Uses MFI & Stochastic as supporting filters to strengthen reversal confirmation and remove noise

When parameters are aligned by trend level, the signal quality increases significantly

🎯 When you combine Zigzag Swing Pro + Multi-Osc OB/OS Overlap

you not only know when to enter a reversal –

you’ll know which trend you’re reversing, and how far you can aim.

🧠 Summary:

You can’t trade reversals effectively if you don’t know what you’re actually reversing.

Once you identify the right trend level, understand how price structures stack across layers, and use the right tools for confirmation – reversal signals become much easier to read – and much more reliable.

🎁 Want the complete Zigzag Swing Pro + Multi-Osc OB/OS Overlap setup + step-by-step usage guide?

Just comment “REVERSE” below.

I’ll send you:

• Pre-configured installation files

• Optimized parameters by trend level

• A live chart walkthrough video – if you need one

🚫 Don’t try to catch bottoms.

✅ Catch the real shift of the trend that’s coming to an end.

You can refer to the Zigzag Swing Pro + Multi-Osc OB/OS Overlap here:

https://ninza.co/product/zigzag-swing-pro

https://ninza.co/product/multi-osc-obos-overlap