In technical analysis, few tools are as simple - yet as powerful - as the trendline. While it’s often underestimated, a properly drawn and interpreted trendline can give you high-probability trading signals when combined with price action, volume, and context.

In this post, let’s walk through everything from the basics to advanced strategies - including how to use Trendline Autom@ton to automate multi-timeframe trendline analysis.

1. What Is a Trendline?

A trendline is a straight line that connects rising lows in an uptrend, or falling highs in a downtrend. It helps:

Identify the overall market direction

Act as support/resistance

Confirm the strength or weakness of a trend

Trendlines reflect market psychology, when price respects the trendline, the trend is intact. When it breaks, something may be shifting.

2. How to Draw a Proper Trendline

To make your trendline reliable, follow these principles:

You need at least two touchpoints, ideally three or more

The points should align with the natural structure of price

Keep the slope reasonable - too steep = easily broken; too flat = less meaningful

3. How to Use Trendlines in Trading

Trendline Break + High Volume = Powerful Confirmation

One of the strong signals is when a trendline breaks with a spike in volume:

- If an uptrend line breaks with heavy selling volume, it often confirms a bearish shift

- If a downtrend line breaks with strong buying volume, it suggests a real breakout

🎯 Volume is the footprint of smart money. No volume = no conviction.

Trade With the Trendline and the Trend

Trendlines help you follow the trend, not fight it:

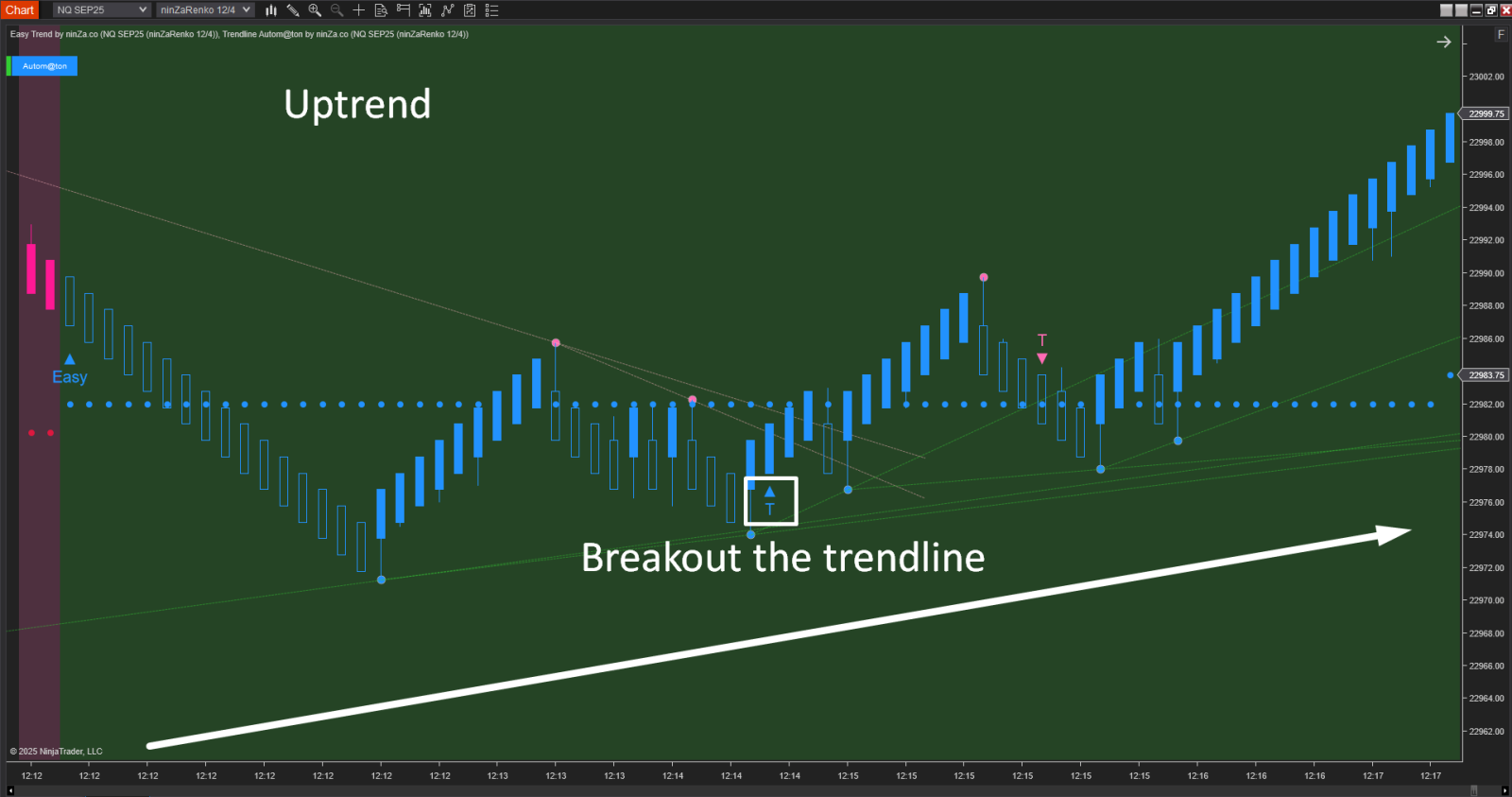

- In an uptrend → draw a trendline along rising lows → look to buy the pullbacks

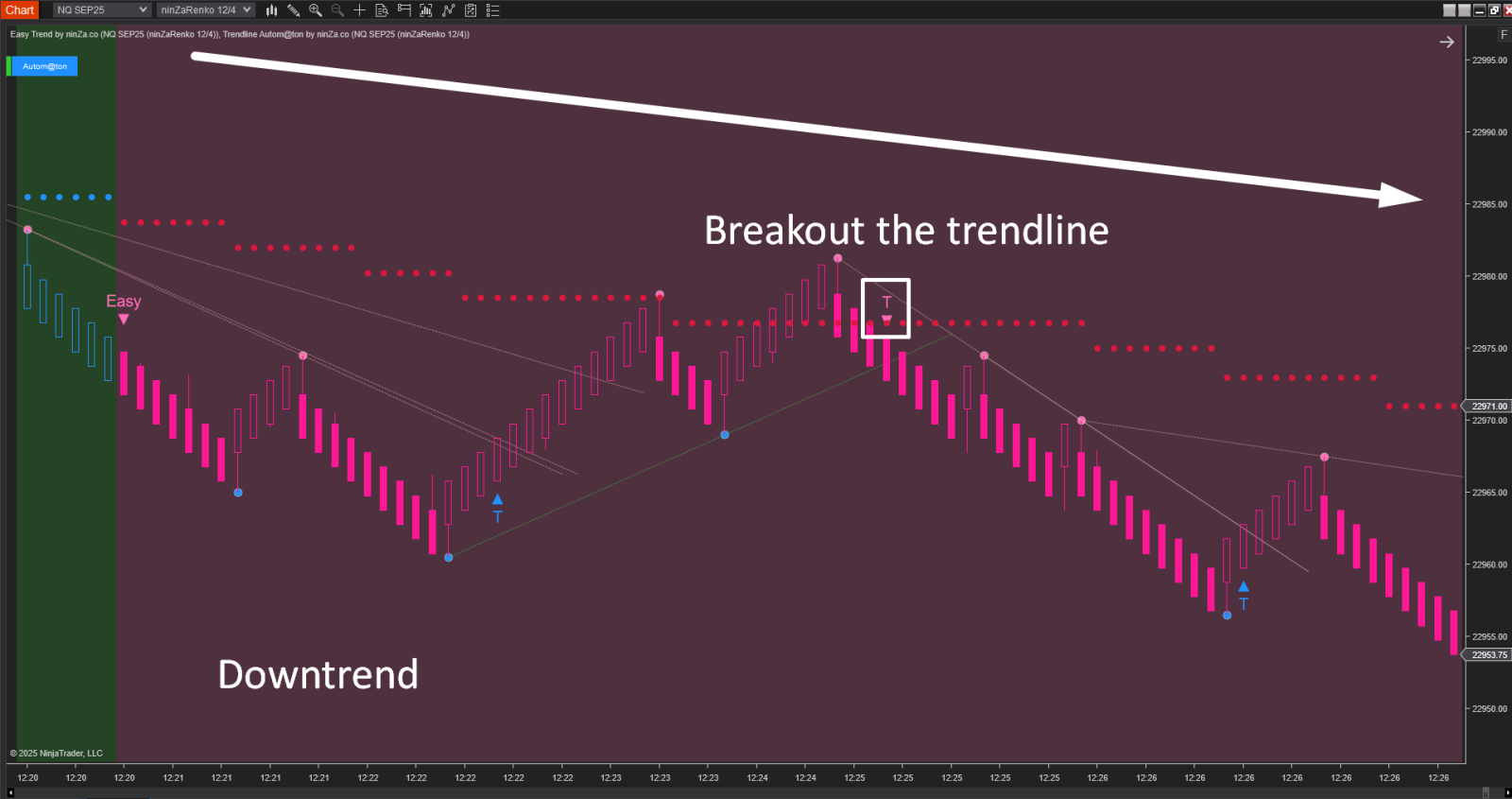

- In a downtrend → draw a line along falling highs → look to sell the rallies

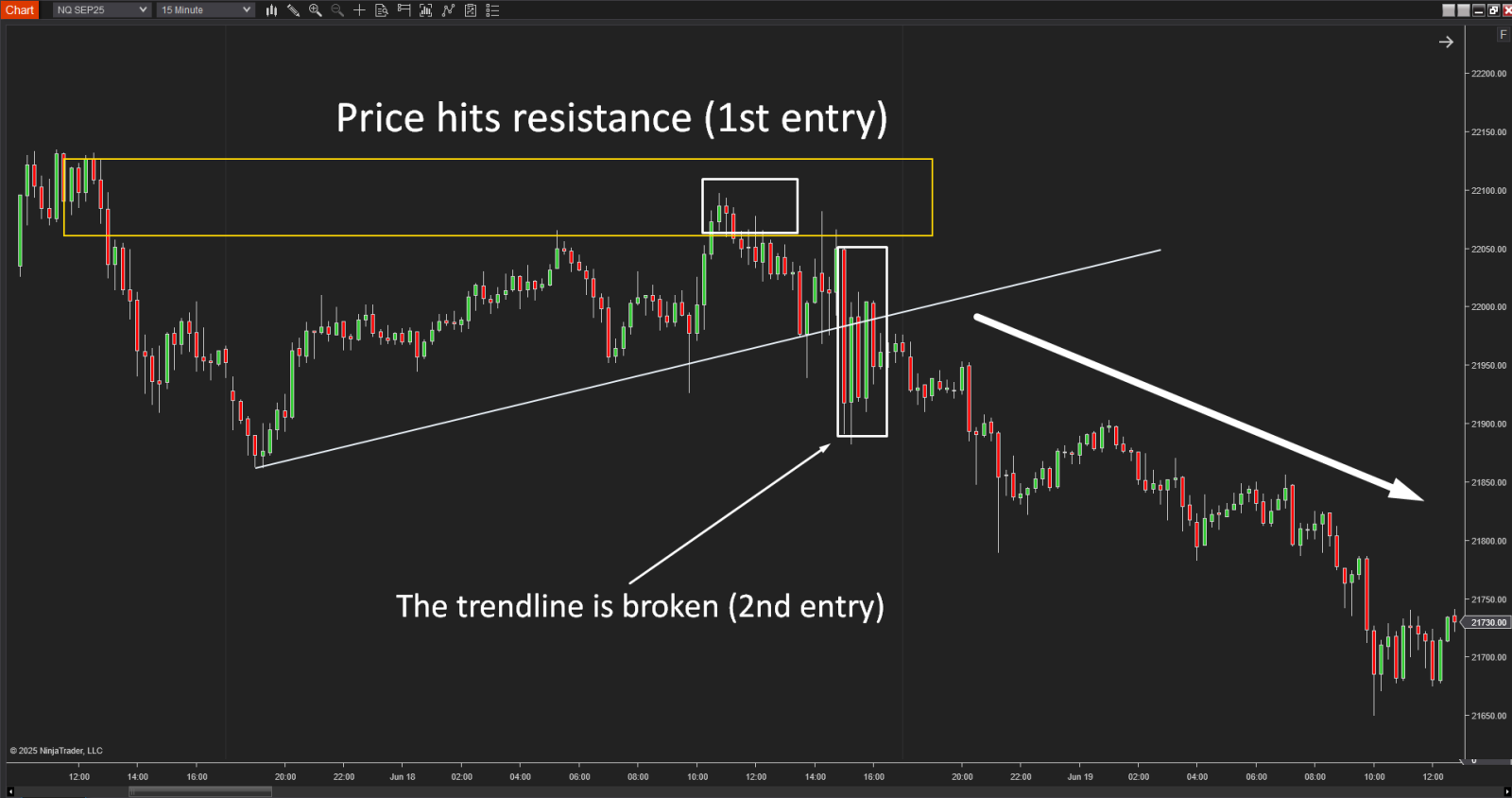

When Price Hits S/R Then Breaks the Trendline = High-Conviction Setup

A powerful setup happens when:

In this case, the trendline becomes a confirmation tool - it shows that the S/R zone was strong enough to trigger a directional shift.

Multi-Timeframe Trendline Strategy Using Trendline Autom@ton

Multi-timeframe analysis is essential for serious traders. But drawing trendlines on every timeframe manually is time-consuming and messy.

Enter: Trendline Autom@ton – an indicator that automatically draws trendlines across different timeframes.

🔹 Key Benefits:

Auto-detects valid trendlines on any timeframe

Lets you see short-, medium-, and long-term trend structure on a single chart

Eliminates guesswork and saves time

Step-by-step: How to Use Trendline Autom@ton Effectively

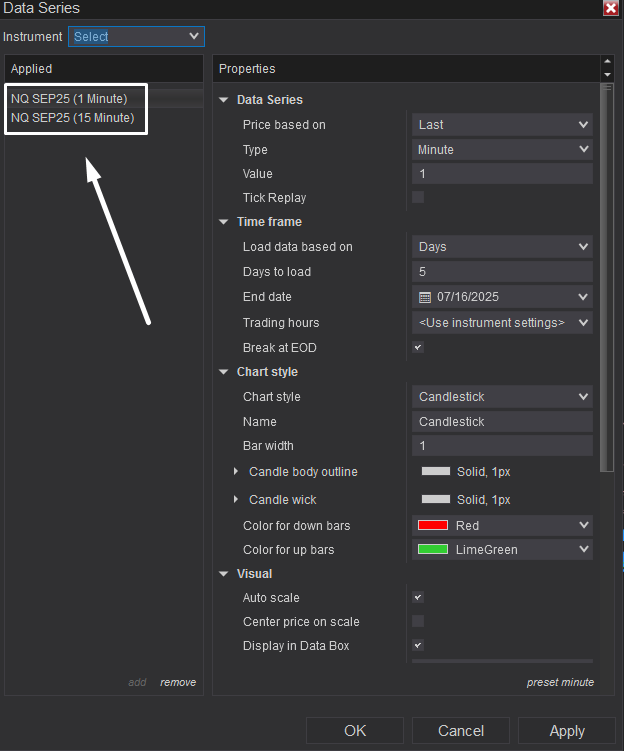

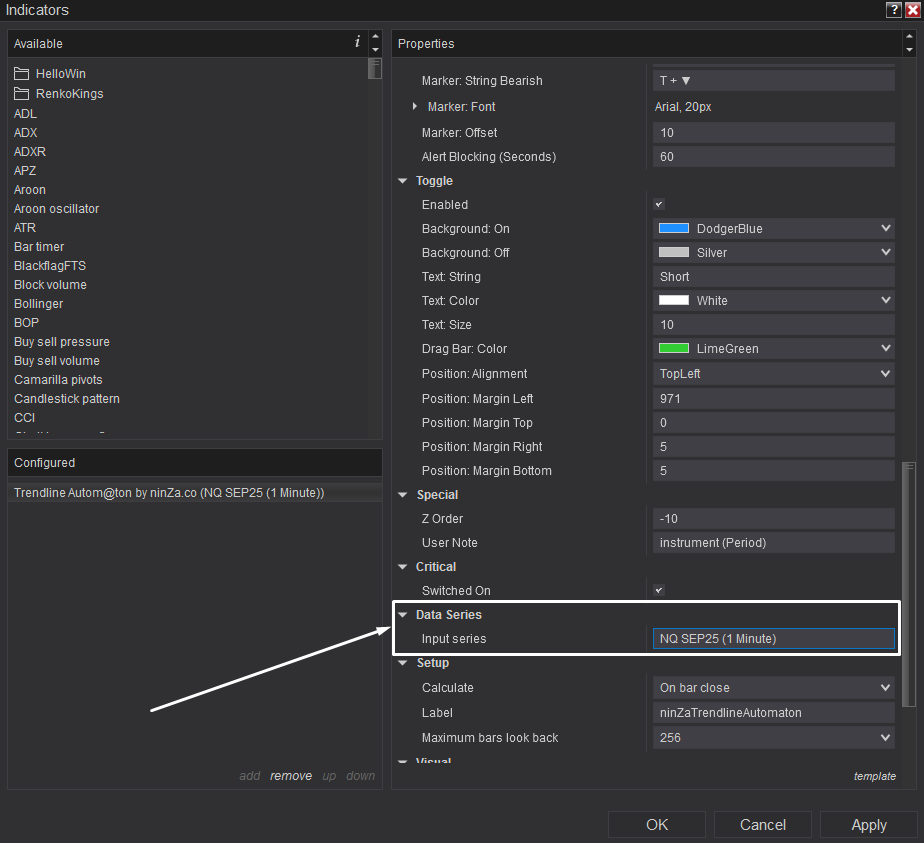

Step 1: Select the timeframe you want to use consistently across the data series.

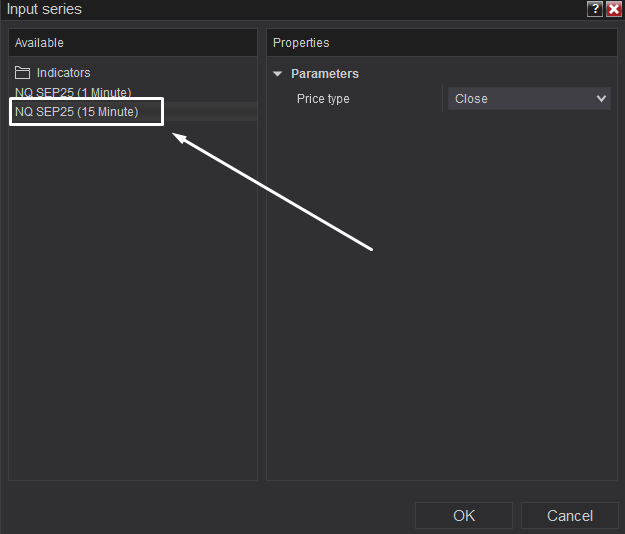

Step 2: Change the input setting to match the timeframe you just added to the data series.

Step 3: Adjust the panel setting so that the trendlines drawn on the higher timeframe can be displayed on the lower timeframe where you plan to trade.

Step-by-Step: How to Use Trendline Autom@ton Effectively

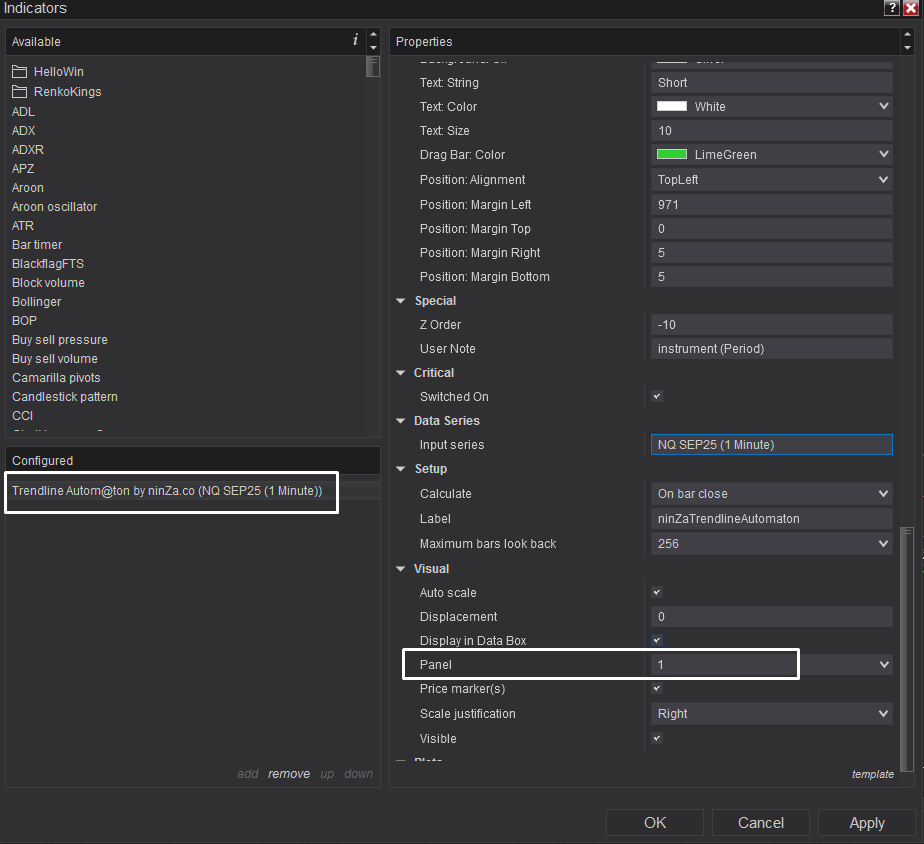

Step 1: Add 3 instances of the indicator to your chart

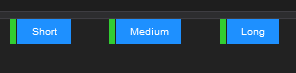

→ One for each trendline period (Short, Medium & Long)

Step 2: Configure each instance with different settings

→ Adjust the parameters to suit short, medium, and long trendlines

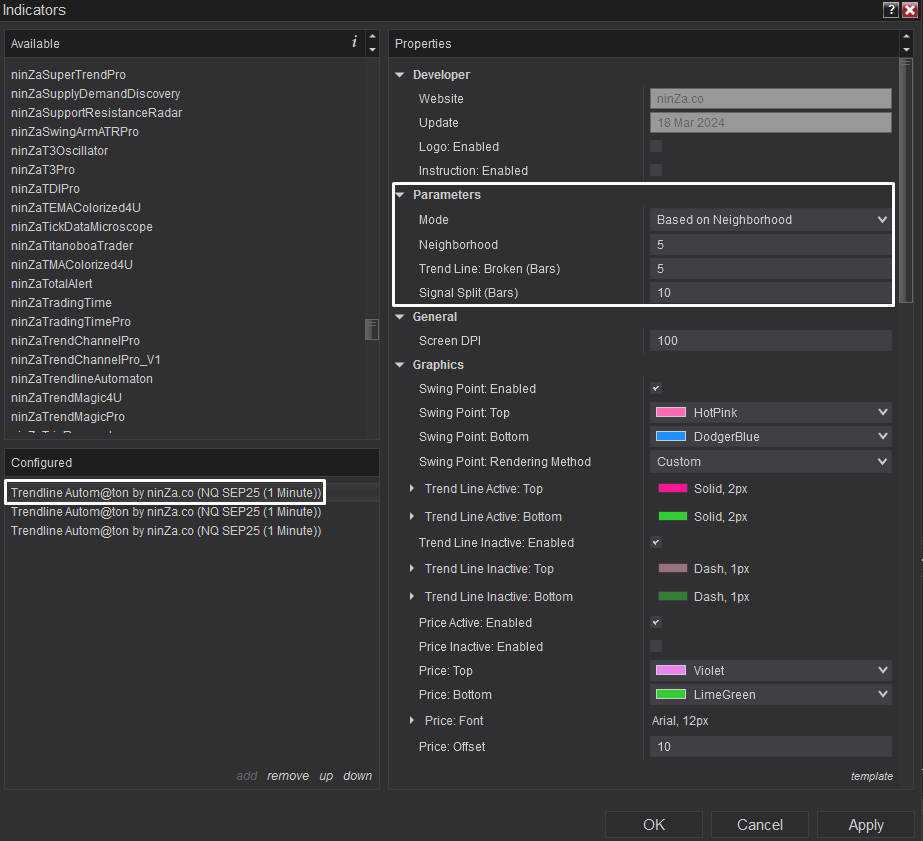

Setting for Short trendline:

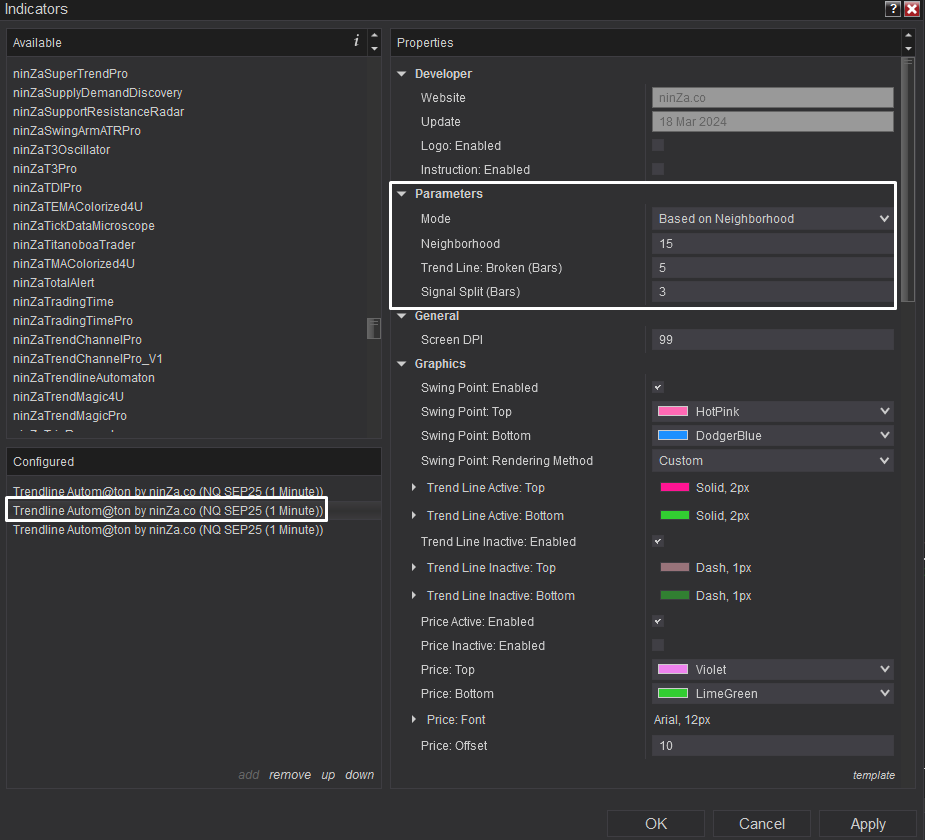

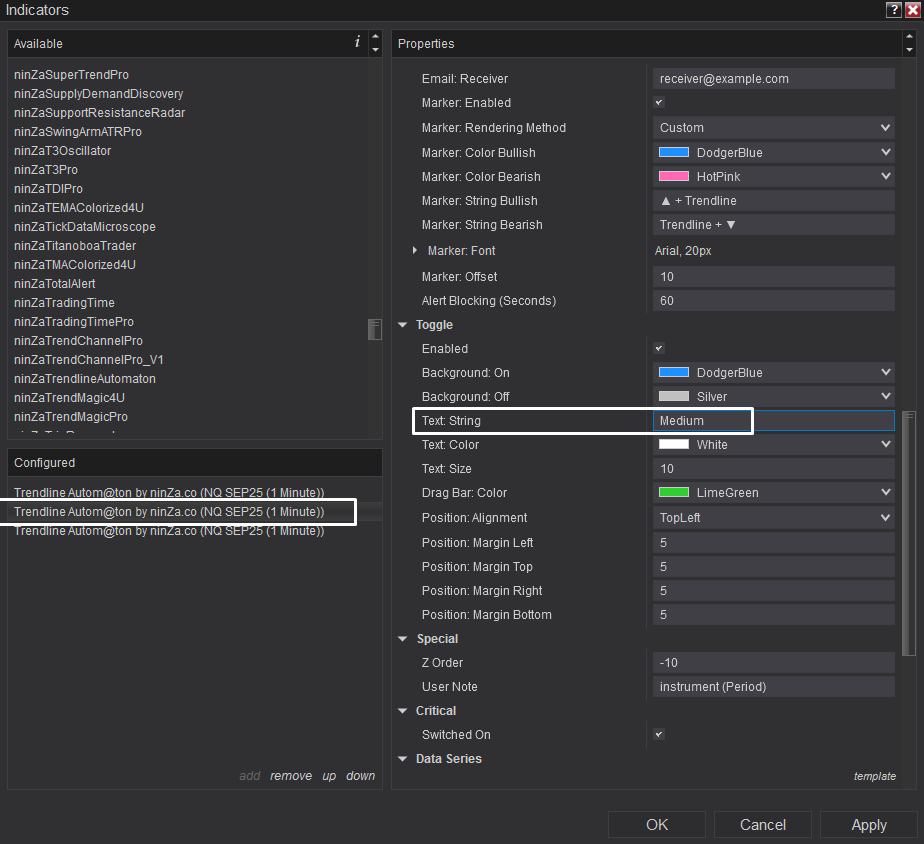

Setting for Medium trendline:

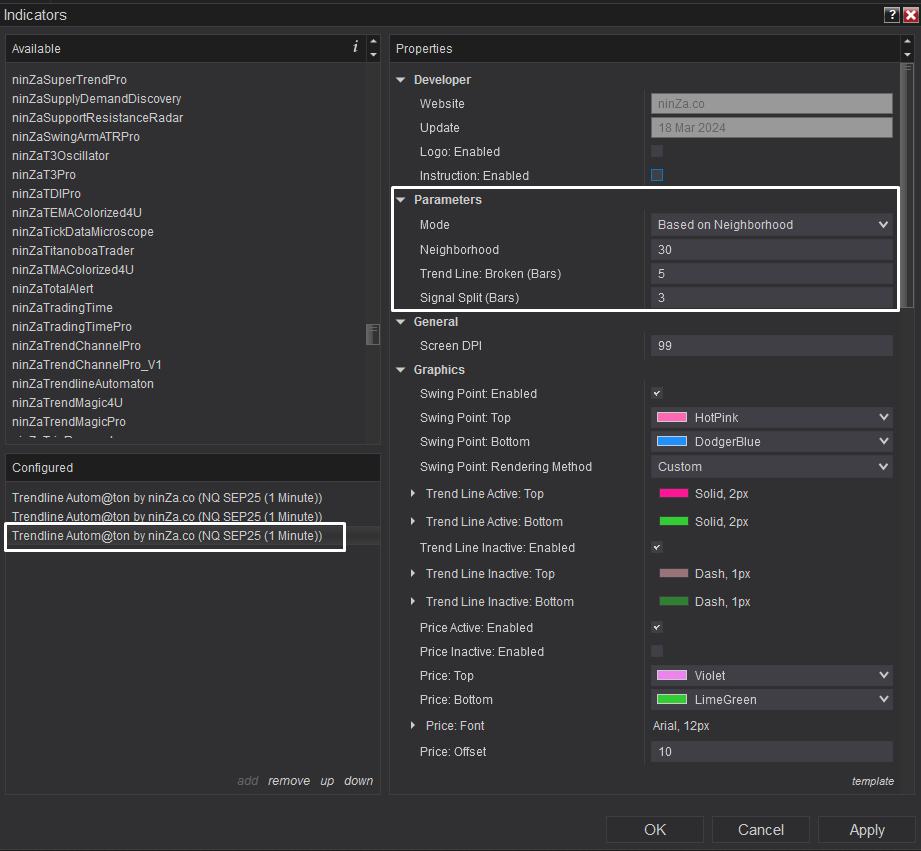

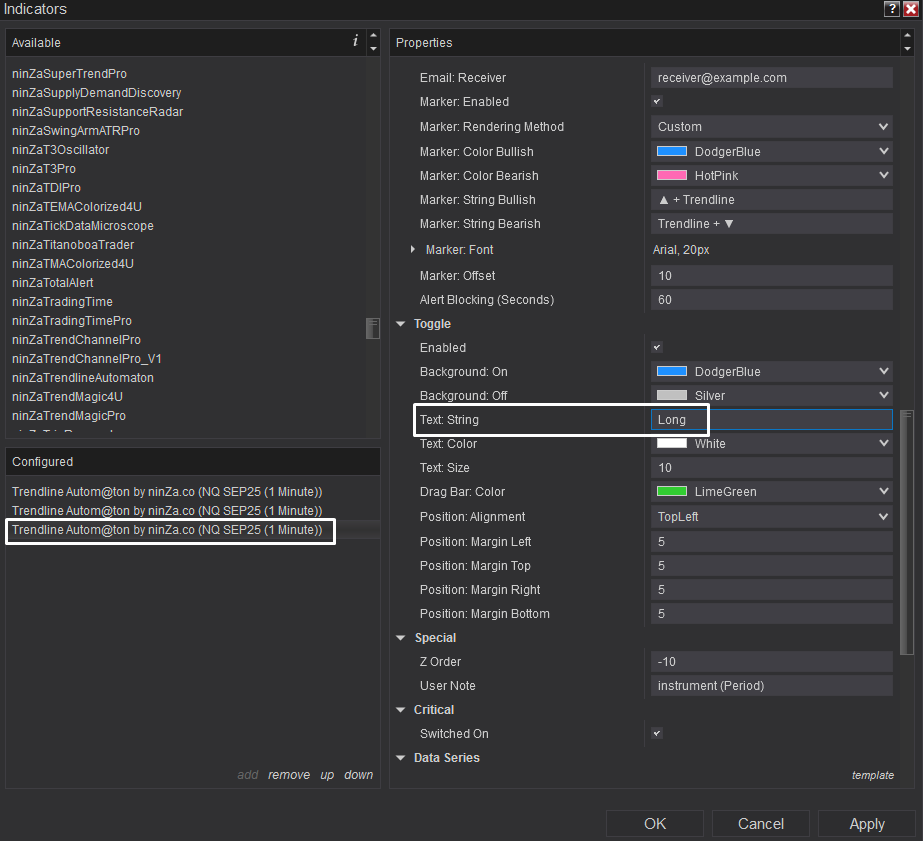

Setting for Long trendline:

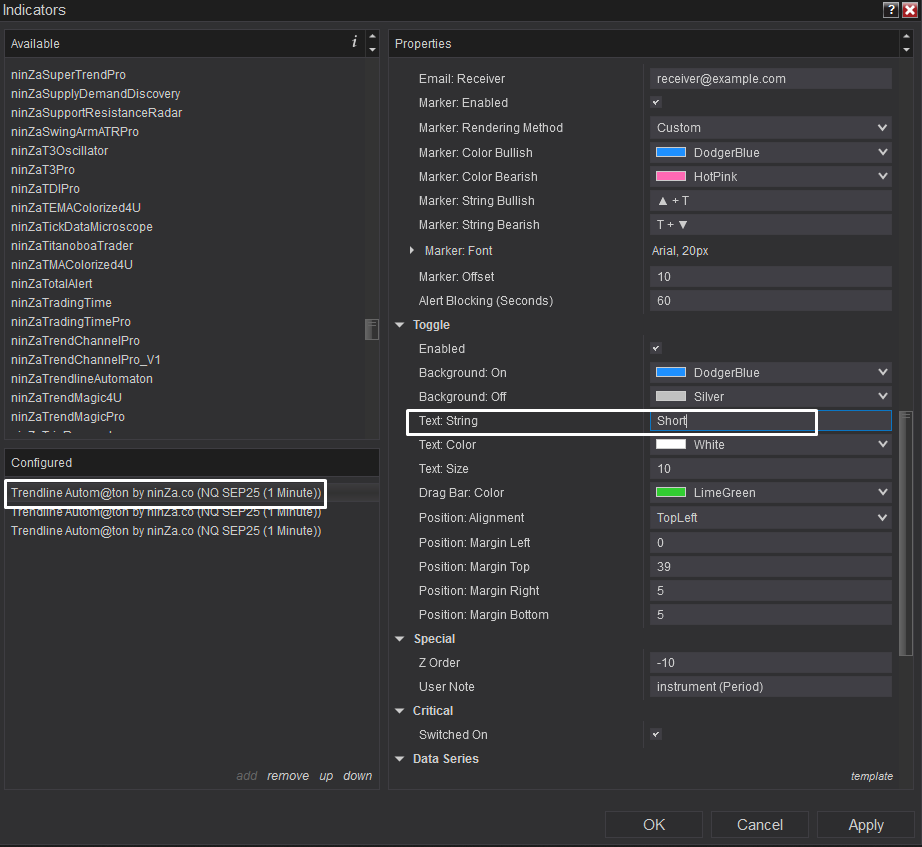

Step 3: Rename for each

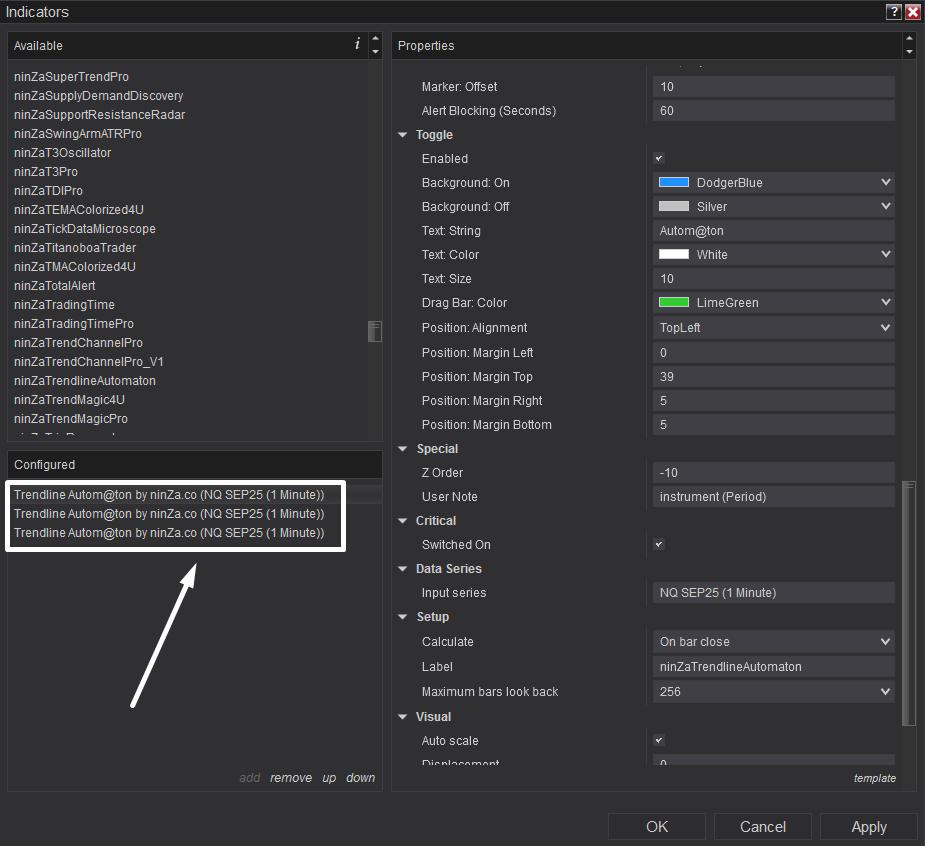

Step 4: Toggle visibility based on your strategy

→ For scalping, focus on short-term lines

→ For swing trades, combine medium and long-term trendlines for confluence

If you're interested in the Autom@ton trendline, you can check it out via the link below. Thanks a lot!

Trendline Autom@ton: https://ninza.co/product/trendline-automaton