If you’ve been looking for a way to build your own trading strategies without being locked into someone else’s rules, Captain Optimus Strong might just be what you need.

It’s a semi-automated system that helps you design strategies using the indicators and systems you already prefer. But because Captain Optimus Strong is quite flexible, we’ve noticed that traders often have similar questions when they first start.

Here are the 5 most common issues traders face — and how to solve them — so you can get the most out of Captain Optimus Strong.

1. “When does Captain Optimus Strong actually give a signal?”

One of the most frequent questions we get is: “I don’t understand when Captain Optimus Strong decides to give me a trade signal.”

The answer is simple: Captain Optimus Strong works on the principle of overlap.

That means you can add as many indicators and systems as you like — trend indicators, zone indicators, signal indicators, and more — and the system will wait until they all agree (overlap) before it triggers a signal.

For example: You might add a trend indicator + a support/resistance zone system + a signal indicator. When all of these line up in the same direction, that’s when the system gives you the green light to trade.

2. "How do I integrate multiple indicators & systems in Captain Optimus Strong to form a strategy?"

Many traders wonder how to make their chosen indicators and systems “talk” to each other inside Captain Optimus Strong so they can work as one strategy.

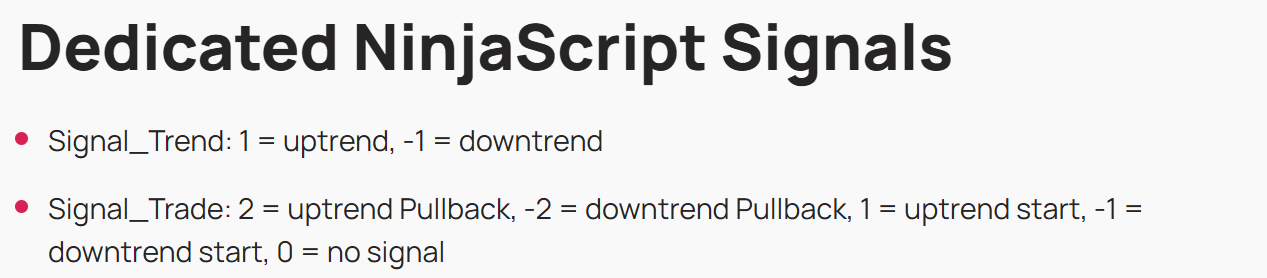

Here’s how it works: Captain Optimus Strong uses dedicated signal codes to connect everything.

Almost all of our indicators and systems come with their own dedicated signal codes, which you’ll find clearly listed on the product page.

For example, if you want to include Easy Trend in your strategy and let Captain Optimus Strong recognize its signals, you just enter its signal code exactly as shown in the product description.

Captain Optimus Strong then uses these codes to check for overlapping signals from the indicators/systems you’ve added — and gives you a trade signal when they align.

3. “How do I combine indicators effectively?”

This is where many traders make mistakes — by combining too many similar indicators, which can actually weaken your strategy instead of strengthening it.

Here are a few tips:

✅ If you trade with trend signals:

Combine trend indicators that use different mechanisms, rather than stacking multiple of the same type (like too many moving averages). For instance, pairing a Moving Average with ATR or ADX can help filter out false signals more effectively.

✅ If you trade reversals:

You can combine indicators like King Order Block (zone-based) and Multi-Osc OB/OS Overlap (signal-based) to build a strategy that focuses on supply/demand reversal zones.

✅ If you trade pullbacks:

You might use a trend indicator (like Solar Wave or PANA Kanal) to define the market direction, then add a signal indicator like Sumo Pullback$ to catch pullbacks within that trend.

By mixing complementary tools — rather than duplicating the same kind — your signals will usually be more reliable.

4. “Can I fully trust backtest results?”

It’s easy to get excited when backtest results look great, but remember:

Backtests only show how your strategy would have performed in the past. That doesn’t guarantee future performance.

Instead, treat backtesting as a way to understand the strengths and weaknesses of your strategy, and then build a risk management and position sizing plan around it. That way, you’re prepared for both good and bad market conditions.

5. “How do I control how many signals to take?”

Sometimes traders feel overwhelmed by too many signals. With Captain Optimus Strong’s updated feature, you can now choose to trade only the first ‘n’ signals (buy or sell) and ignore the rest.

Why is this useful?

Because the earlier signals in a trend often have higher reliability. By focusing on those, you avoid chasing weaker setups that appear later.

Bonus: “Can I exit when the overlap ends?”

Many traders don’t want to exit their trades just because price hits a stop, target, or because a new signal appears. Instead, they prefer to stay in the trade as long as the indicators still overlap, and exit when that overlap ends.

That’s now possible with Captain Optimus Strong’s newest feature:

You can set your trades to automatically close when the signal overlap ends.

This is especially useful for trend-following traders who want to ride the trend longer but still have a logical exit point, without worrying about staying in too long.

Captain Optimus Strong gives you an incredible amount of flexibility to design your own strategies while keeping clear rules and automation in place. If you take the time to understand these common issues and use the tips above, you’ll find it much easier (and more effective) to trade with this system.