Have you ever felt certain about your analysis, yet the market moved completely against your expectations? You're not alone. Many seasoned traders often fall victim to hidden "blind spots" in their technical analysis without even realizing it.

What are blind spots and why are they dangerous?

Blind spots in technical analysis are subtle yet critical errors or oversights traders frequently ignore, causing inaccurate or distorted trade decisions. These mistakes persistently recur, damaging trading performance and causing prolonged losses.

Top 3 common blind spots in technical analysis:

1. Ignoring the Bigger Picture (Higher Timeframe)

Many traders focus excessively on small timeframes (M1, M5), neglecting broader timeframes (H1, H4, Daily). Ignoring these higher perspectives means missing the overall trend, increasing the risk of being trapped in market "fakeouts."

2. Overloading Charts with Indicators

Traders often clutter their charts with numerous indicators. Though seemingly helpful, this habit causes confusion, making it difficult to decisively interpret signals.

3. Neglecting Volume & Order Flow

Technical analysis isn't just about price charts or candlestick patterns. Ignoring volume and order flow leaves traders unaware of how institutional money truly moves, creating major blind spots.

How to eliminate these blind spots?

The simplest solution is integrating specialized analytical tools into your trading strategy. These tools help clarify market conditions, minimize noise, and accurately identify smart money flows.

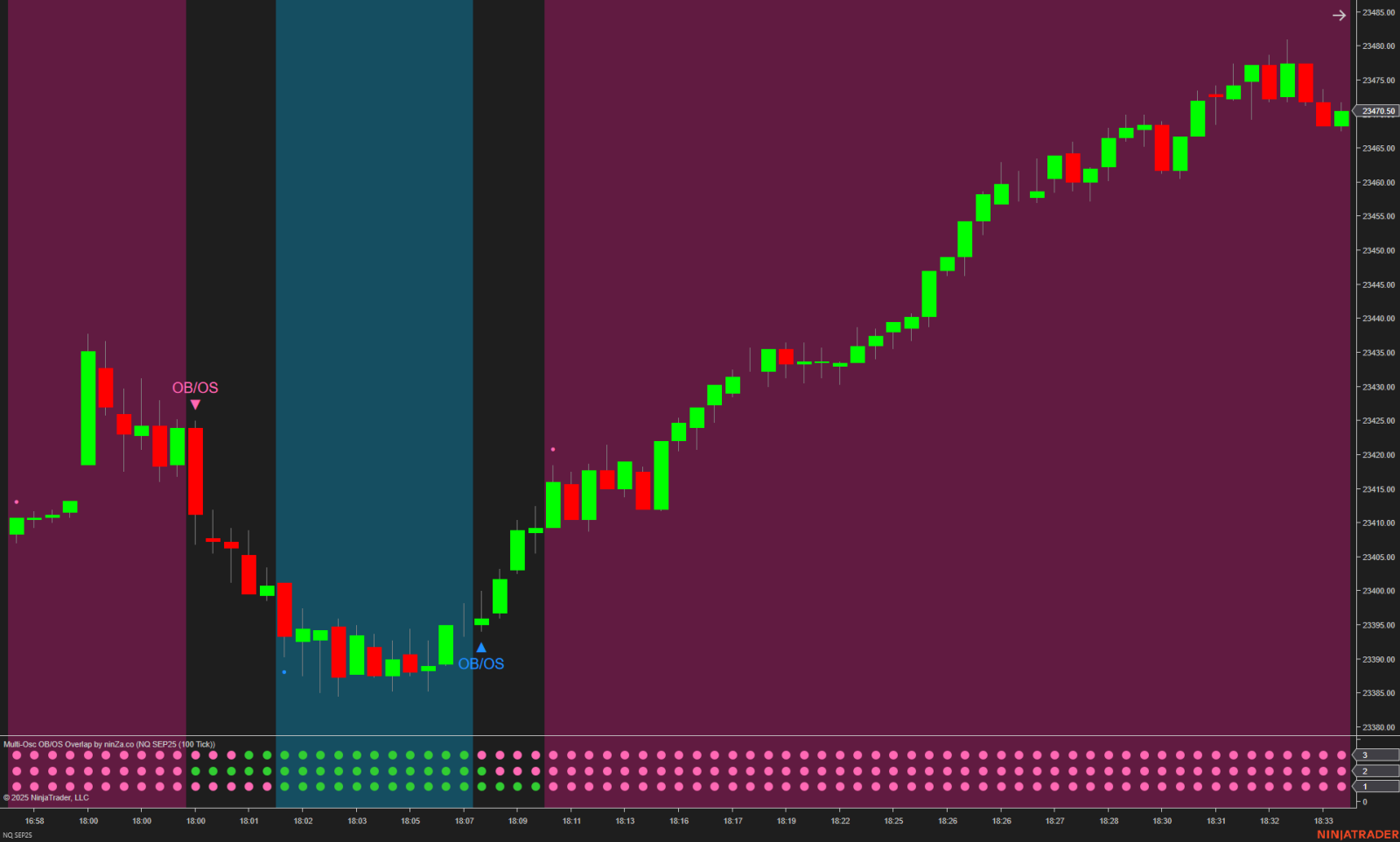

A particularly effective solution is ninZa.co’s "Multi-Osc OB/OS Overlap", highly recommended by professional traders for precisely identifying overbought/oversold zones.

Link here : Awesome Oscillator NinjaTrader 8: Multi-Osc OB/OS Overlap - ninZa.co

How does Multi-Osc OB/OS Overlap help you?

Combines multiple powerful oscillators (RSI, Stochastic, etc.) in one indicator to pinpoint potential reversals clearly.

Reduces signal noise, preventing common mistakes such as catching “falling knives” or entering trades prematurely.

Increases trade accuracy through clear, confirmed entry conditions.

Real-life Example:

For example, during a strong uptrend, inexperienced traders might prematurely short the market, hoping for quick reversals. However, using Multi-Osc OB/OS Overlap, you'll clearly see oscillators have not simultaneously entered overbought conditions. This insight helps you avoid false signals and wait patiently for better setups, protecting your capital.

Practical Tips to Avoid Blind Spots:

Always verify at least two timeframes before entering a trade (multi-timeframe analysis).

Streamline your indicators, prioritizing high-quality, specialized tools.

Confirm trades with Order Flow or Volume, especially during critical reversal signals.