"If you look at the market from only one timeframe, you’re missing half the story"

Multi-timeframe analysis is mandatory for pro traders

It blends the big picture from higher timeframes with precision from lower ones to boost decision accuracy

1. Advantages

See the big picture – Avoid trading against the dominant trend

Higher win probability – Enter when signals align with the higher TF trend

Optimize entries/exits – Lower TFs fine-tune timing and reduce stops

Noise reduction – Filter out single-TF false signals

2. Disadvantages & challenges

Time-consuming manual work – Opening 3–5 charts clutters the screen

Hard to sync signals – Different TFs may conflict, causing hesitation

Info overload – Too much data leads to analysis paralysis

Lack of broader confirmation – Focusing on one market may give weak signals

3. ninZa.co solutions

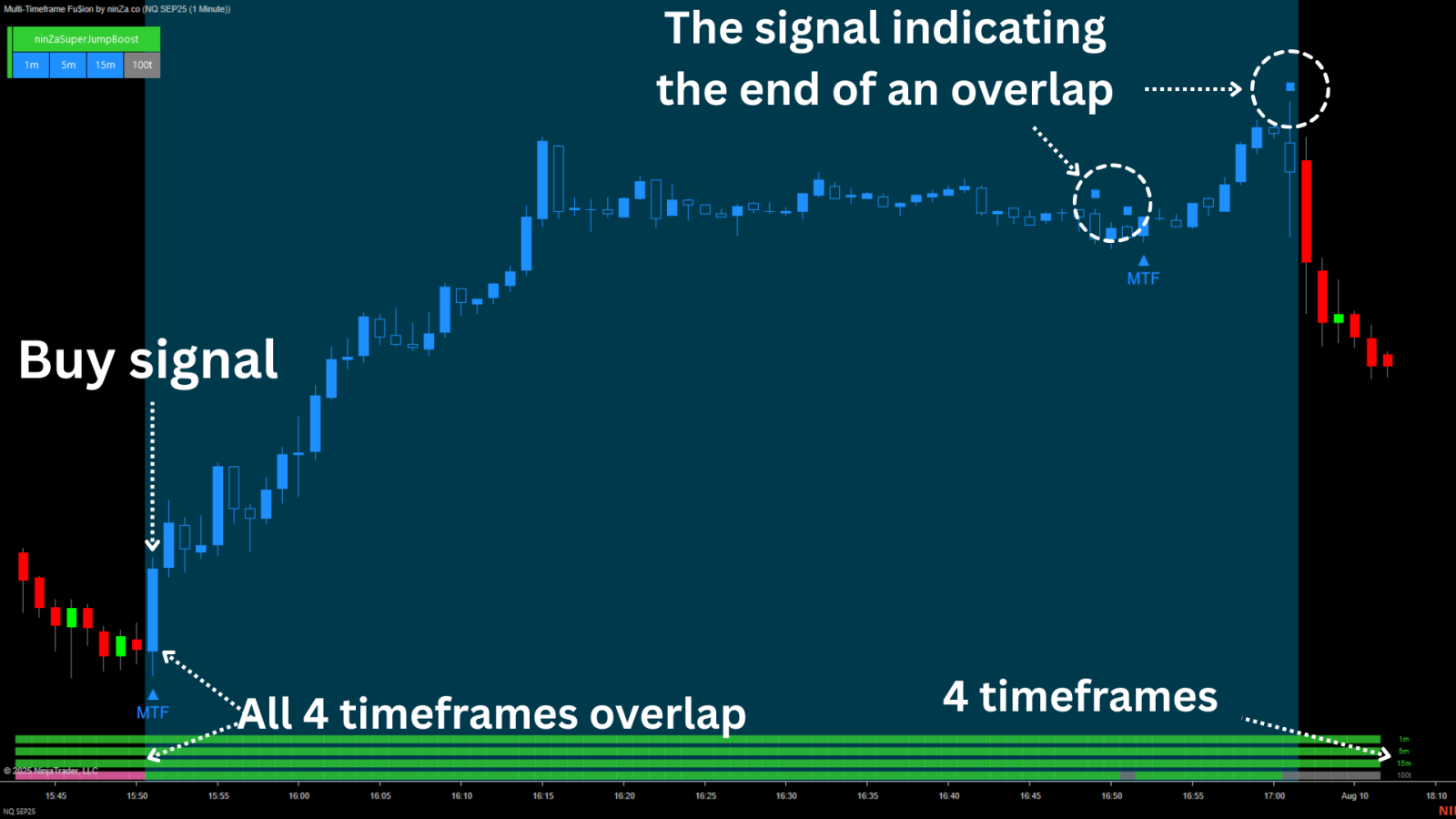

Multi-Timeframe Fu$ion – Solving sync & speed issues

Signal mechanism: Pulls signals from 5 TFs of a chosen indicator, displays them on 1 chart, highlights consensus when all TFs align

How to use:

Pick base indicator

Select 5 TFs

Watch highlighted zones for entries

Fixes challenges:

No need for multiple charts → less clutter, faster workflow

Automatic consensus alerts → removes hesitation

Benefit: Fast, clear multi-TF synchronization

Link: Best NinjaTrader Multi Time Frame Indicator - ninZa.co

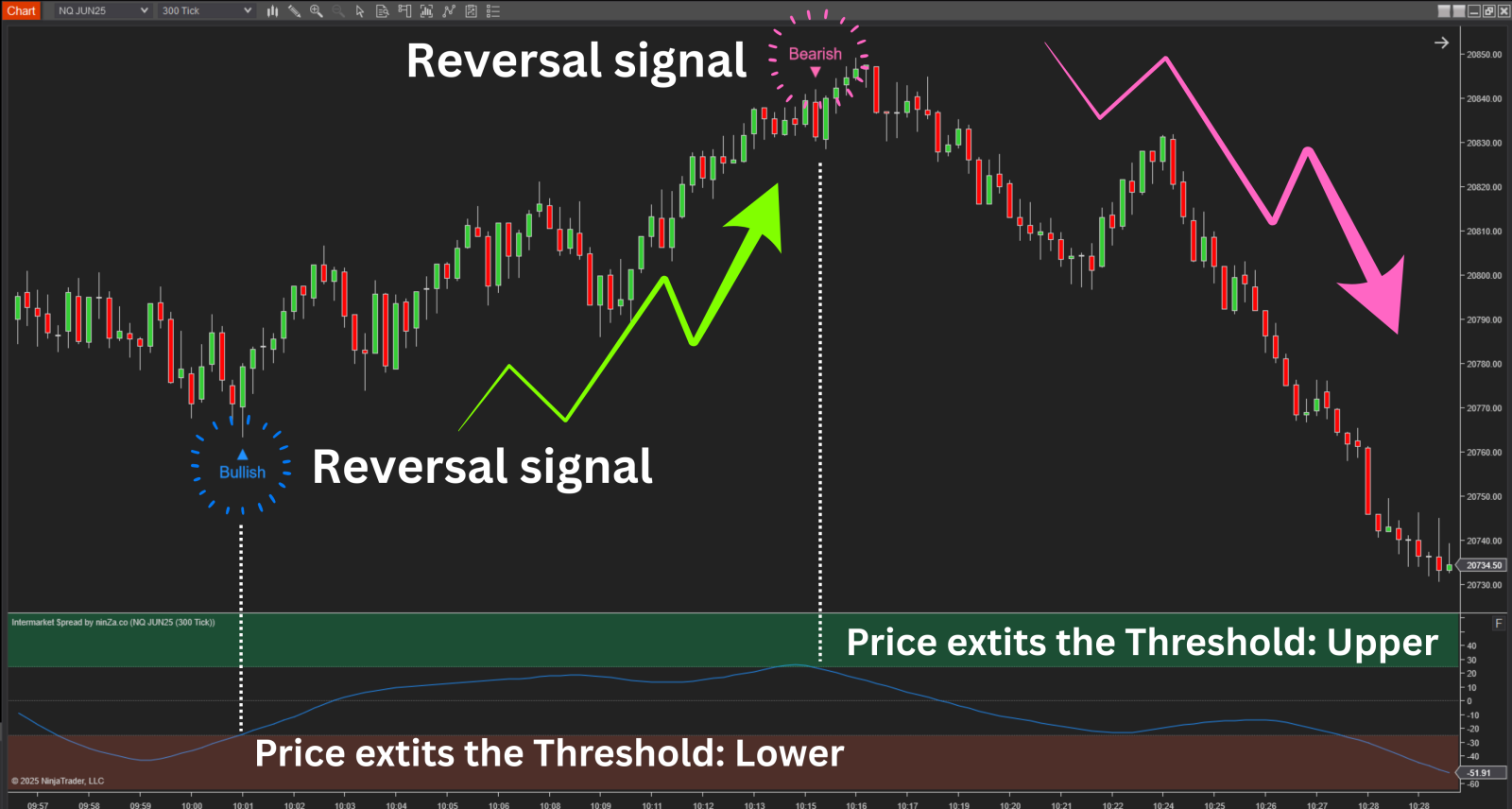

Intermarket $pread – Solving broader market confirmation

Signal mechanism: Tracks 2+ instruments across multiple TFs to find consensus or divergence

How to use:

Choose related instruments (e.g., NQ – ES – YM)

Assign TFs

Use spread chart for confirmation

Fixes challenges:

Benefit: Validates reversal signals, avoids being fooled by local moves

Link: Intermarket $pread: Top NinjaTrader Multi Time Frame Strategy

4. Final thought

Multi-timeframe analysis offers huge advantages but also real challenges

With Multi-Timeframe Fu$ion and Intermarket $pread, you shorten analysis time, remove TF conflicts, and boost the certainty of your trades