Breakouts are among the most attractive trading signals for traders. When the price breaks through a significant support or resistance zone, momentum often explodes, offering an immediate profit opportunity:

Breaking resistance – Buyers dominate, price tends to surge

Breaking support – Sellers dominate, price tends to plunge

On the chart, these moves look “clean” and very attractive.

But in real trading, things are rarely that simple. What seems like a perfect breakout often turns into frustration and losses.

Here are the main reasons why breakout trading is so challenging:

1. Retests after breakouts

A retest of the broken support or resistance zone follows most genuine breakouts.

Traders often get confused: is it just a healthy retest or the start of a reversal? Many exit too early during the retest and miss the big move afterward.

2. Fake breakouts

Sometimes the market only “pokes” above resistance or “dips” below support before snapping back.

These false breakouts trap traders into bad entries and cause unnecessary losses – One of the most frustrating experiences in trading.

3. Breakouts move too fast, causing Slippage

On volatility-based charts (tick, Renko…), breakouts can happen in seconds.

Traders either fail to enter in time or jump in late, suffering slippage and ending up with poor entry prices.

4. FOMO and chasing price

Before a breakout occurs, the market often makes an initial push.

The fear of missing out (FOMO) tempts traders to buy at highs or sell at lows, leading to entries at risky levels and increased chances of reversal against them.

How to reduce Breakout trading risks

Place stop loss wisely – Not too close to support/resistance zones

Use trading tools – Identify genuine breakouts, reduce slippage, and improve entry timing

Combine breakout + reversal strategies – Build better positions and improve win rates

Proven solutions for Breakout trading with confidence

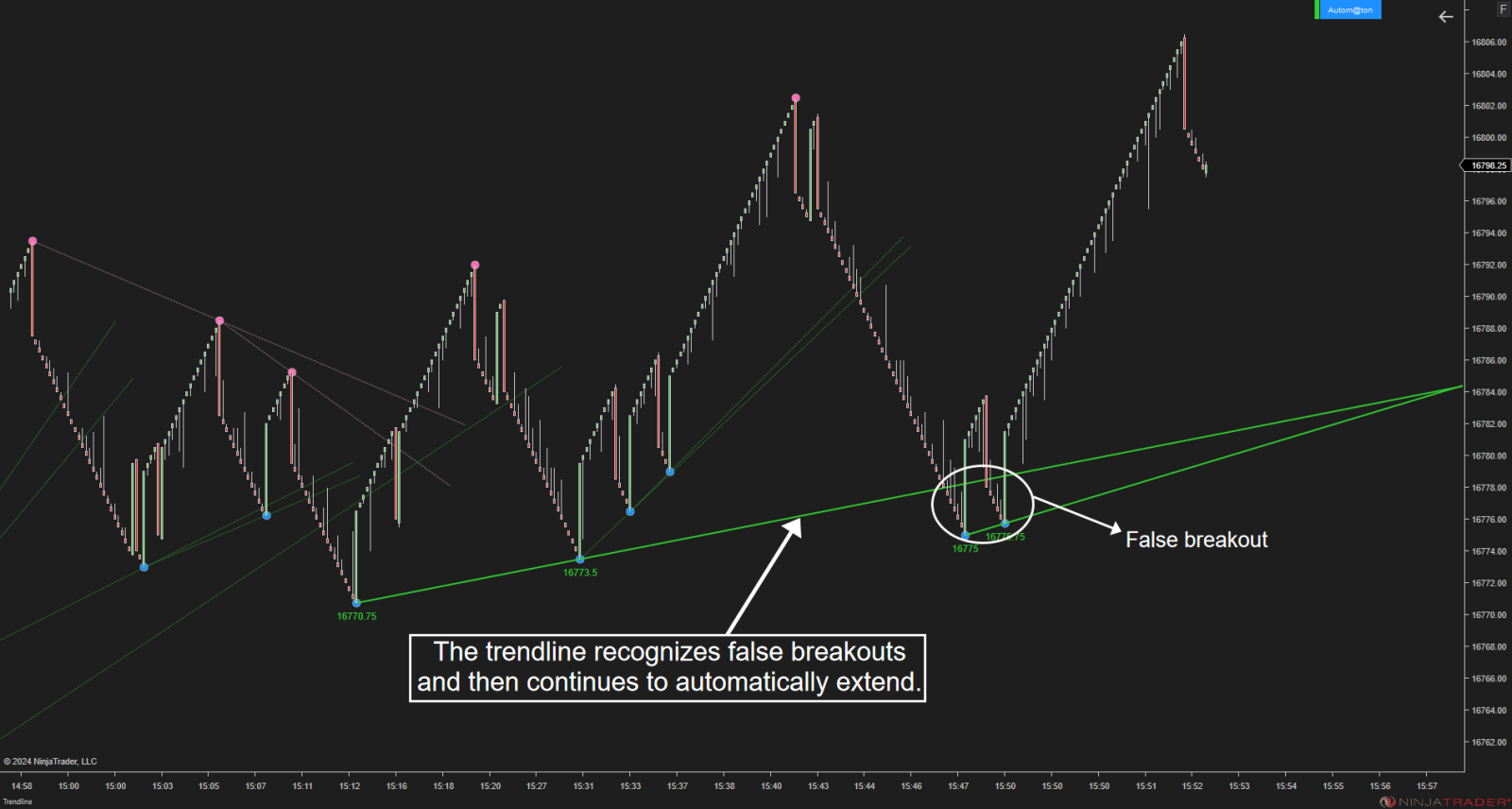

Trendline Autom@ton

Automatically draws reliable trendlines to identify support/resistance zones clearly

Smart fake breakout filter – Trendlines only confirm breakouts when they truly happen according to your parameters

→ Ideal for avoiding noise from retests or false breakouts

🔗 https://ninza.co/product/trendline-automaton

🎉 Use code BREAKOUT52 at checkout to receive 52% OFF all the products featured in this post.

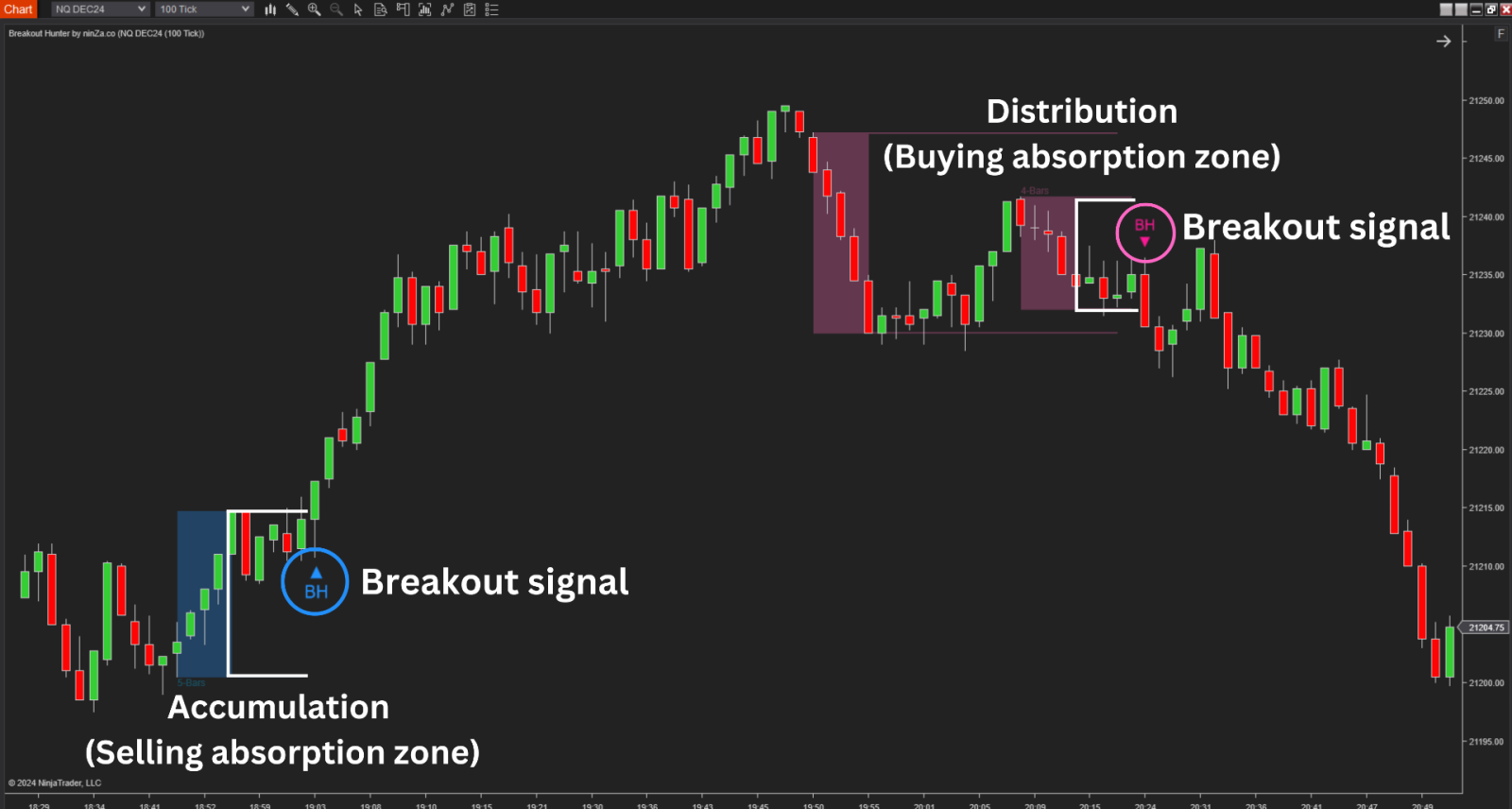

Breakout Hunter (Based on Wyckoff Theory)

Detects accumulation and distribution zones – The starting points of strong breakouts

Alerts breakout signals when the price exits these zones, helping you enter at the right time

→ Reduces FOMO risk and prevents late entries

🔗 https://ninza.co/product/breakout-hunter

🎉 Use code BREAKOUT52 at checkout to receive 52% OFF all the products featured in this post.

Sidewayz RT + Sidewayz MA + Sidewayz ZP Combo

Triple filter for detecting sideways/choppy markets – The worst conditions for breakout traders

→ Helps you avoid trading breakouts during low-momentum phases.

🎉 Use code BREAKOUT52 at checkout to receive 52% OFF all the products featured in this post.

In trading, timing and precision matter most. With the right tools, you can recognize breakouts more clearly and manage them in a way that supports consistent results.