Hello traders,

One effective method for improving the dependability of signals involves leveraging the correlation between instruments.

Nonetheless, the manual comparison of price movements can be time-consuming, potentially causing delays in trade execution.

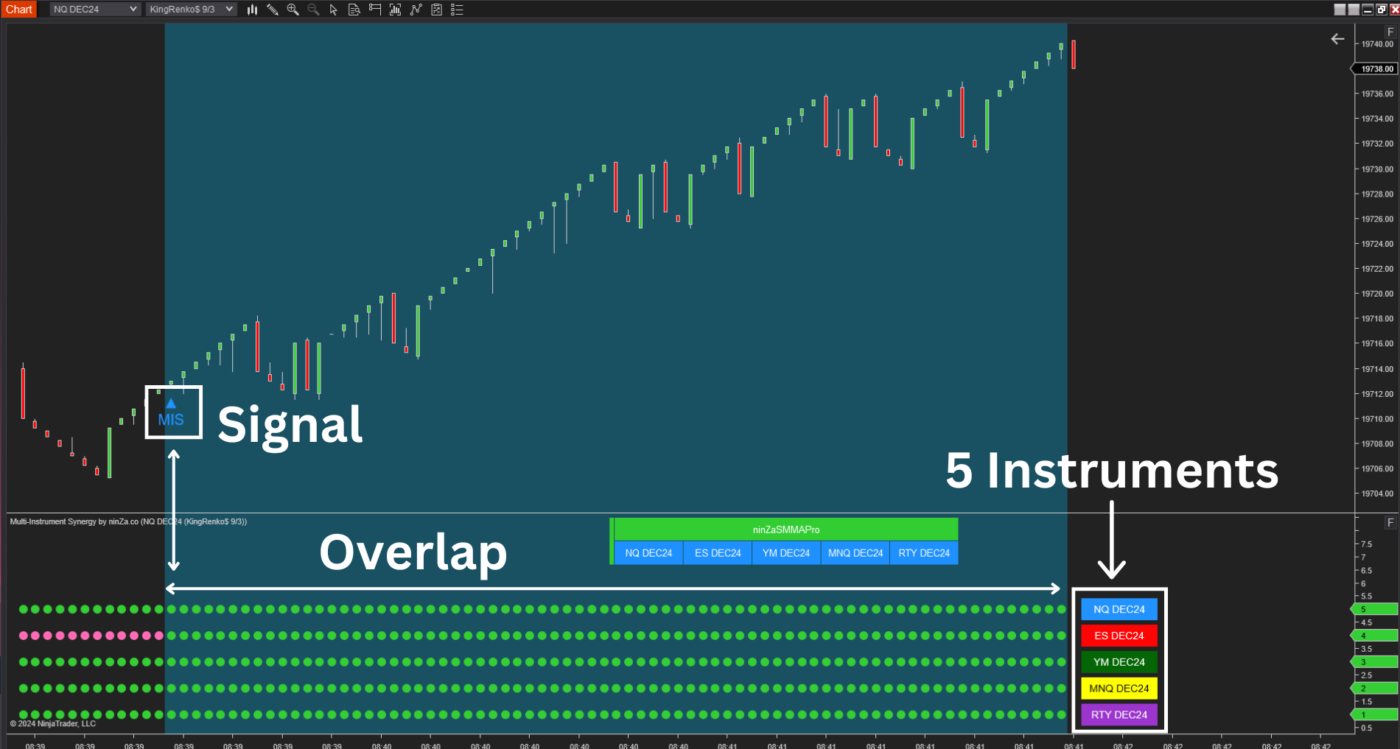

Multi-Instrument Synergy streamlines this task by displaying the signals of 5 different instruments on only ONE chart.

A positive correlation indicates a group of instruments that usually move in the same direction.

→ For instance, the NQ and ES often demonstrate a positive correlation, meaning they typically rise or fall together. This indicator facilitates the quick identification of synchronized price movements among these instruments.

A negative correlation describes a set of instruments that generally move in opposing directions.

→ For example, the relationship between Gold and ES pair showcases a negative correlation. This indicator assists you in confirming these opposite movements, thereby improving the reliability of trend predictions for either instrument.

Utilizing a signal generation mechanism based on overlap, Multi-Instrument Synergy allows you to quickly ascertain whether multiple instruments are moving in sync or in opposition on 1 chart.

If you believe this indicator could be beneficial, we invite you to explore it 👉https://ninza.co/product/multi-instrument-synergy