Dear Amar,

Thank you so much for being a part of the ninZa.co community and for taking the time to share your honest thoughts. We truly value your feedback and appreciate your continued support.

Let me take a moment to address your concerns with full transparency.

🔁 Why do we release multiple indicators for similar purposes?

In trading, a single core concept can be interpreted and applied in many different ways.

For example:

Supply and demand zones can be detected through Imbalance, BoS/CHoCH, Swing Points, or Volume-based logic.

Trend detection can be done via Moving Averages, ATR, momentum shifts, and more.

Each trader has their own approach and preference. Some rely on volume, others prefer clean price action or structure-based analysis. With a diverse and growing customer base, our goal is to offer a flexible ecosystem of tools, giving each trader options that suit their unique style.

So when you see multiple indicators aimed at the same task, they’re not duplicates - they’re different lenses designed to help you view the market from the angle that resonates best with your strategy.

♻️ Legacy indicators are still relevant and maintained

Releasing new indicators does not mean older products are obsolete.

In fact, many of our long-time customers continue using older tools because they align better with their current trading system and thought process.

The key difference lies in how the logic is implemented - not in which is “better.” Each version shines under specific market conditions and strategies.

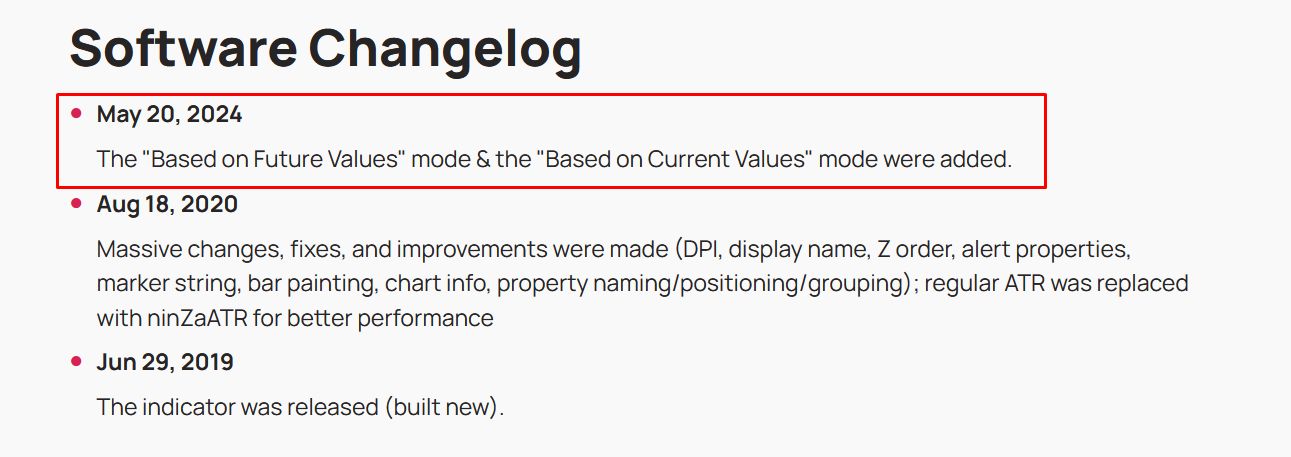

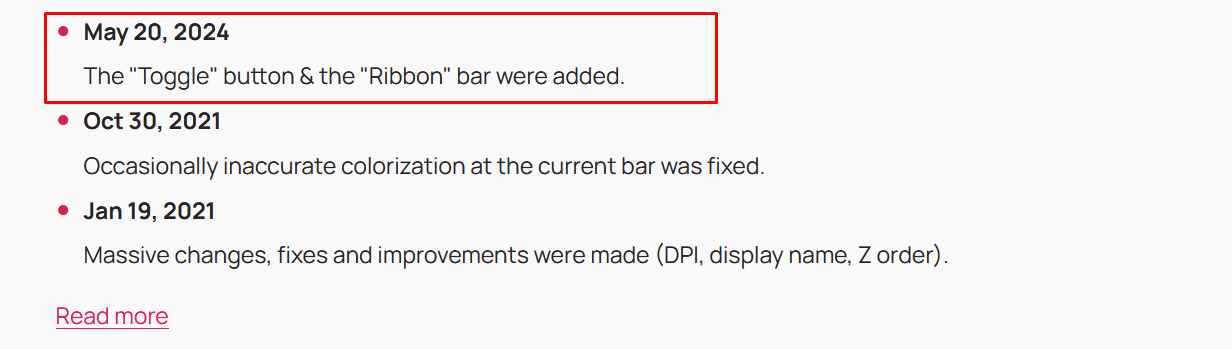

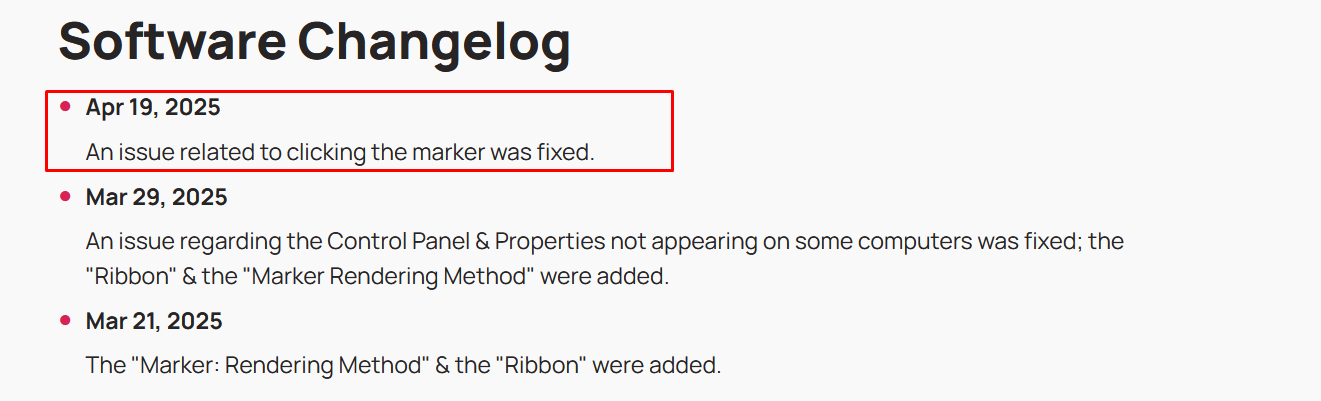

We also want to assure you that legacy indicators are actively maintained and updated based on user feedback. You can always check the Changelog on each product page to see how frequently we update even tools that were released years ago. Many of those improvements come directly from user suggestions - just like yours.

📉 Great backtest but still losing in live trading?

Many traders achieve excellent backtest results - high win rates, consistent profits, low drawdowns.

However, once they apply the same strategy in live trading… everything falls apart.

One of the biggest reasons?

They follow the backtest setup blindly, without analyzing or adapting to current market conditions. They simply trust the system to do all the work, even using a fixed ATM strategy for every market scenario.

That’s a critical mistake.

📌 Backtesting is just a “rearview mirror”

Backtesting is like looking in the rearview mirror while driving.

Everything seems clear - because it already happened.

But in live trading, you must react to what hasn’t happened yet - at full speed, under pressure, and with real risk involved.

Backtesting usually involves:

Fixed historical data

Emotionless, robotic decisions

Fixed ATM settings (e.g. 50-tick SL, 200-tick TP)

Under these ideal conditions, results naturally look great.

But in the real market...

⚠️ Fixed ATM strategies don’t work in live trading

Market conditions change constantly:

Some sessions are highly volatile, others are flat.

Some days trend cleanly, others are choppy and noisy.

If you use the same ATM strategy regardless of market context, you risk:

There are trades you could have won — by trailing the stop, adjusting position size, or taking partial profits.

But using a rigid ATM strategy like in backtesting can turn those winning setups into losses.

Worse yet, the strategy itself might be valid, but you're still knocked out by poor stop/target configuration.

✅ Adaptive risk management is the real edge

What backtesting can’t measure accurately is market context and the need for dynamic trade management.

Here’s what you can do:

Assess session volatility using tools like ATR, volume, or market structure to determine optimal SL/TP.

Adjust your ATM settings throughout the day based on real-time conditions.

Don’t be afraid to change your trade management - as long as it’s based on clear logic and objective metrics.

👉 A strategy only truly survives and thrives when paired with flexible, real-world risk management.

💬 Final Words – Friendly & Heartfelt

We truly hope that through this message, you not only gain a better understanding of trading - but also feel that you’re not alone in this journey.

We want you to know that we’re always here, listening to every bit of feedback, improving every day, and doing our best to support you in the most meaningful way we can.

Every product and every tool we create serves a unique purpose.

There’s no such thing as a perfect indicator - but when you take the time to understand it well and make it your own, it becomes far more than just a tool… it becomes a part of your edge.

But here’s the most important part:

Even if you already own a product, even if it didn’t “click” for you right away - we’re still here for you.

Please don’t hesitate to tell us where you’re struggling.

We’ll do our best to support you, share insights, and walk alongside you - not just as a support team, but as a team that truly cares about your trading growth.

Because in the end, trading is more than entries and exits - it’s a journey that takes patience, self-mastery, and the right people by your side.

And we’d be honored to be part of that journey with you. 💛